- 2022-04-07 发布 |

- 37.5 KB |

- 47页

申明敬告: 本站不保证该用户上传的文档完整性,不预览、不比对内容而直接下载产生的反悔问题本站不予受理。

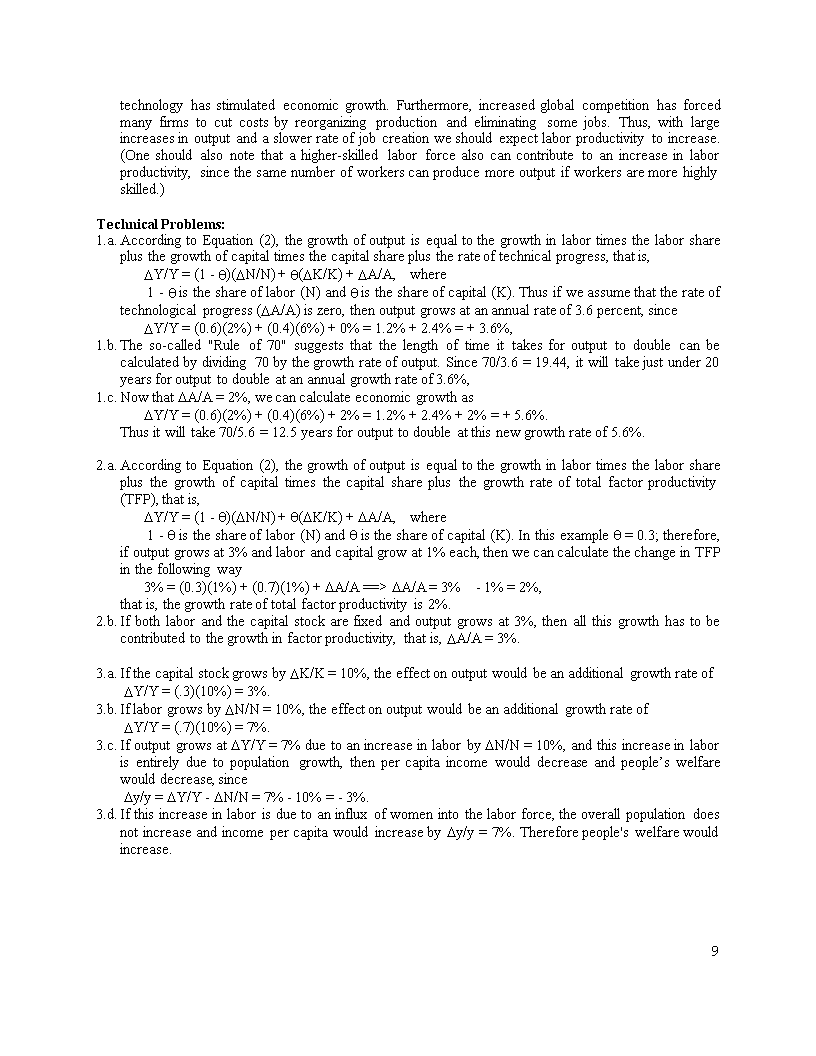

文档介绍

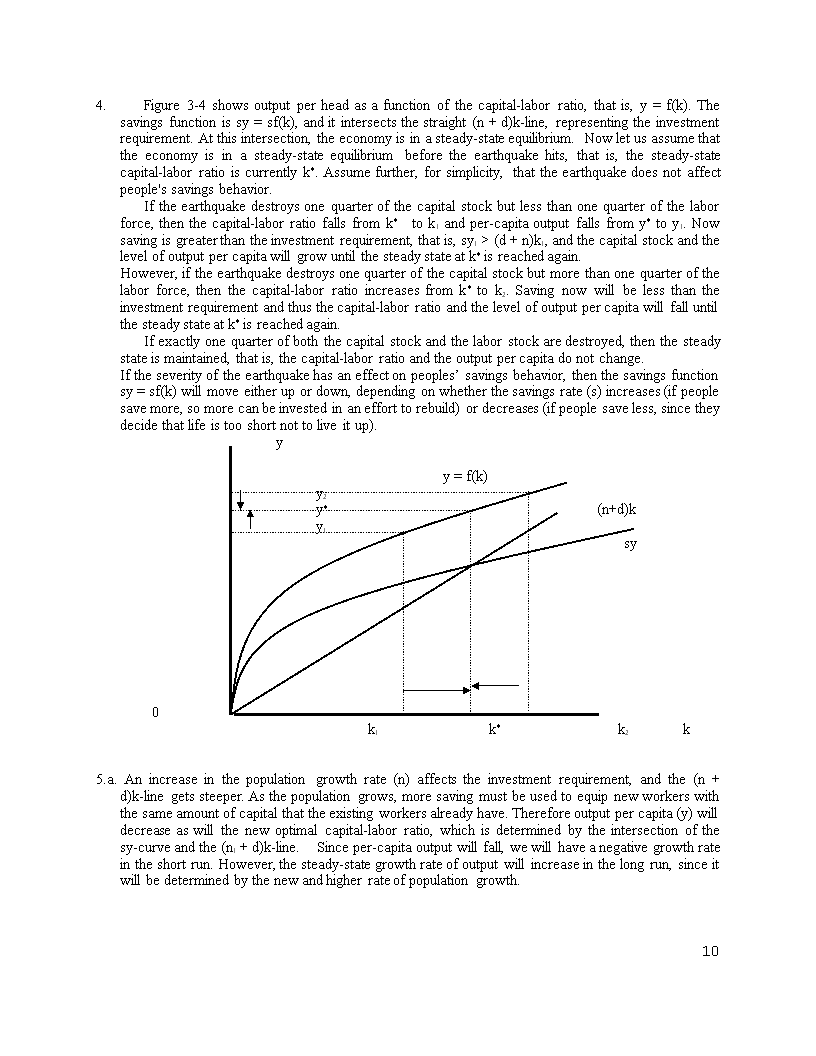

多恩布什宏观经济学第十版课后习题答案03-09

CHAPTER3SolutionstotheProblemsintheTextbookConceptualProblems:1.Theproductionfunctionprovidesaquantitativelinkbetweeninputsandoutput.Forexample,theCobb-Douglasproductionfunctionmentionedinthetextisoftheform:Y=F(N,K)=AN1-qKq,whereYrepresentsthelevelofoutput.(1-q)andqareweightsequaltothesharesoflabor(N)andcapital(K)inproduction,whileAisoftenusedasameasurefortheleveloftechnology.Itcanbeeasilyshownthatlaborandcapitaleachcontributetoeconomicgrowthbyanamountthatisequaltotheirindividualgrowthratesmultipliedbytheirrespectiveshareinincome.2.TheSolowmodelpredictsconvergence,thatis,countrieswiththesameproductionfunction,savingsrate,andpopulationgrowthwilleventuallyreachthesamelevelofincomepercapita.Inotherwords,apoorcountrymayeventuallycatchuptoaricheronebysavingatthesamerateandmakingtechnologicalinnovations.However,ifthesecountrieshavedifferentsavingsrates,theywillreachdifferentlevelsofincomepercapita,eventhoughtheirlong-termgrowthrateswillbethesame.3.Aproductionfunctionthatomitsthestockofnaturalresourcescannotadequatelypredicttheimpactofasignificantchangeintheexistingstockofnaturalresourcesontheeconomicperformanceofacountry.Forexample,thediscoveryofnewoilreservesoranentirelynewresourcewouldhaveasignificanteffectonthelevelofoutputthatcouldnotbepredictedbysuchaproductionfunction.4.InterpretingtheSolowresidualpurelyastechnologicalprogresswouldignore,forexample,theimpactthathumancapitalhasonthelevelofoutput.Inotherwords,thisresidualnotonlycapturestheeffectoftechnologicalprogressbutalsotheeffectofchangesinhumancapital(H)onthegrowthrateofoutput.Toeliminatethisproblemwecanexplicitlyincludehumancapitalintheproductionfunction,suchthatY=F(K,N,H)=ANaKbHcwitha+b+c=1.ThenthegrowthrateofoutputcanbecalculatedasDY/Y=DA/A+a(DN/N)+b(DK/K)+c(DH/H).5.Thesavingsfunctionsy=sf(k)assumesthataconstantfractionofoutputissaved.Theinvestmentrequirement,thatis,the(n+d)k-line,representstheamountofinvestmentneededtomaintainaconstantcapital-laborratio(k).Asteady-stateequilibriumisreachedwhensavingisequaltotheinvestmentrequirement,thatis,whensy=(n+d)k.Atthispointthecapital-laborratiok=K/Nisnotchanging,socapital(K),labor(N),andoutput(Y)allmustbegrowingatthesamerate,thatis,therateofpopulationgrowthn=(DN/N).6.Inthelongrun,therateofpopulationgrowthn=(DN/N)determinesthegrowthrateofthesteady-stateoutputpercapita.Intheshortrun,however,thesavingsrate,technologicalprogress,andtherateofdepreciationcanallaffectthegrowthrate.7.LaborproductivityisdefinedasY/N,thatis,theratioofoutput(Y)tolaborinput(N).Asurgeinlaborproductivitythereforeoccursifoutputgrowsatafasterratethanlaborinput.IntheU.S.wehaveexperiencedsuchasurgeinlaborproductivitysincethemid-1990sduetotheenormousgrowthinGDP.Thissurgecanbeexplainedfromtheintroductionofnewtechnologiesandmoreefficientuseofexistingtechnologies.Manyclaimthattheincreasedinvestmentinanduseofcomputer12ntechnologyhasstimulatedeconomicgrowth.Furthermore,increasedglobalcompetitionhasforcedmanyfirmstocutcostsbyreorganizingproductionandeliminatingsomejobs.Thus,withlargeincreasesinoutputandaslowerrateofjobcreationweshouldexpectlaborproductivitytoincrease.(Oneshouldalsonotethatahigher-skilledlaborforcealsocancontributetoanincreaseinlaborproductivity,sincethesamenumberofworkerscanproducemoreoutputifworkersaremorehighlyskilled.)TechnicalProblems:1.a.AccordingtoEquation(2),thegrowthofoutputisequaltothegrowthinlabortimesthelaborshareplusthegrowthofcapitaltimesthecapitalshareplustherateoftechnicalprogress,thatis,DY/Y=(1-q)(DN/N)+q(DK/K)+DA/A,where1-qistheshareoflabor(N)andqistheshareofcapital(K).Thusifweassumethattherateoftechnologicalprogress(DA/A)iszero,thenoutputgrowsatanannualrateof3.6percent,sinceDY/Y=(0.6)(2%)+(0.4)(6%)+0%=1.2%+2.4%=+3.6%,1.b.Theso-called"Ruleof70"suggeststhatthelengthoftimeittakesforoutputtodoublecanbecalculatedbydividing70bythegrowthrateofoutput.Since70/3.6=19.44,itwilltakejustunder20yearsforoutputtodoubleatanannualgrowthrateof3.6%,1.c.NowthatDA/A=2%,wecancalculateeconomicgrowthasDY/Y=(0.6)(2%)+(0.4)(6%)+2%=1.2%+2.4%+2%=+5.6%.Thusitwilltake70/5.6=12.5yearsforoutputtodoubleatthisnewgrowthrateof5.6%.2.a.AccordingtoEquation(2),thegrowthofoutputisequaltothegrowthinlabortimesthelaborshareplusthegrowthofcapitaltimesthecapitalshareplusthegrowthrateoftotalfactorproductivity(TFP),thatis,DY/Y=(1-q)(DN/N)+q(DK/K)+DA/A,where1-qistheshareoflabor(N)andqistheshareofcapital(K).Inthisexampleq=0.3;therefore,ifoutputgrowsat3%andlaborandcapitalgrowat1%each,thenwecancalculatethechangeinTFPinthefollowingway3%=(0.3)(1%)+(0.7)(1%)+DA/A==>DA/A=3%-1%=2%,thatis,thegrowthrateoftotalfactorproductivityis2%.2.b.Ifbothlaborandthecapitalstockarefixedandoutputgrowsat3%,thenallthisgrowthhastobecontributedtothegrowthinfactorproductivity,thatis,DA/A=3%.3.a.IfthecapitalstockgrowsbyDK/K=10%,theeffectonoutputwouldbeanadditionalgrowthrateofDY/Y=(.3)(10%)=3%.3.b.IflaborgrowsbyDN/N=10%,theeffectonoutputwouldbeanadditionalgrowthrateofDY/Y=(.7)(10%)=7%.3.c.IfoutputgrowsatDY/Y=7%duetoanincreaseinlaborbyDN/N=10%,andthisincreaseinlaborisentirelyduetopopulationgrowth,thenpercapitaincomewoulddecreaseandpeople’swelfarewoulddecrease,sinceDy/y=DY/Y-DN/N=7%-10%=-3%.3.d.Ifthisincreaseinlaborisduetoaninfluxofwomenintothelaborforce,theoverallpopulationdoesnotincreaseandincomepercapitawouldincreasebyDy/y=7%.Thereforepeople'swelfarewouldincrease.12n4.Figure3-4showsoutputperheadasafunctionofthecapital-laborratio,thatis,y=f(k).Thesavingsfunctionissy=sf(k),anditintersectsthestraight(n+d)k-line,representingtheinvestmentrequirement.Atthisintersection,theeconomyisinasteady-stateequilibrium.Nowletusassumethattheeconomyisinasteady-stateequilibriumbeforetheearthquakehits,thatis,thesteady-statecapital-laborratioiscurrentlyk*.Assumefurther,forsimplicity,thattheearthquakedoesnotaffectpeople'ssavingsbehavior.Iftheearthquakedestroysonequarterofthecapitalstockbutlessthanonequarterofthelaborforce,thenthecapital-laborratiofallsfromk*tok1andper-capitaoutputfallsfromy*toy1.Nowsavingisgreaterthantheinvestmentrequirement,thatis,sy1>(d+n)k1,andthecapitalstockandthelevelofoutputpercapitawillgrowuntilthesteadystateatk*isreachedagain.However,iftheearthquakedestroysonequarterofthecapitalstockbutmorethanonequarterofthelaborforce,thenthecapital-laborratioincreasesfromk*tok2.Savingnowwillbelessthantheinvestmentrequirementandthusthecapital-laborratioandthelevelofoutputpercapitawillfalluntilthesteadystateatk*isreachedagain.Ifexactlyonequarterofboththecapitalstockandthelaborstockaredestroyed,thenthesteadystateismaintained,thatis,thecapital-laborratioandtheoutputpercapitadonotchange.Iftheseverityoftheearthquakehasaneffectonpeoples’savingsbehavior,thenthesavingsfunctionsy=sf(k)willmoveeitherupordown,dependingonwhetherthesavingsrate(s)increases(ifpeoplesavemore,somorecanbeinvestedinanefforttorebuild)ordecreases(ifpeoplesaveless,sincetheydecidethatlifeistooshortnottoliveitup).yy=f(k)y2y*(n+d)ky1sy0k1k*k2k5.a.Anincreaseinthepopulationgrowthrate(n)affectstheinvestmentrequirement,andthe(n+d)k-linegetssteeper.Asthepopulationgrows,moresavingmustbeusedtoequipnewworkerswiththesameamountofcapitalthattheexistingworkersalreadyhave.Thereforeoutputpercapita(y)willdecreaseaswillthenewoptimalcapital-laborratio,whichisdeterminedbytheintersectionofthesy-curveandthe(n1+d)k-line.Sinceper-capitaoutputwillfall,wewillhaveanegativegrowthrateintheshortrun.However,thesteady-stategrowthrateofoutputwillincreaseinthelongrun,sinceitwillbedeterminedbythenewandhigherrateofpopulationgrowth.12ny(n1+d)ky=f(k)yo(no+d)ky1sy120k1kok5.b.Startingfromaninitialsteady-stateequilibriumatalevelofper-capitaoutputy*,theincreaseinthepopulationgrowthrate(n)willcausethecapital-laborratiotodeclinefromk*tok1.Outputpercapitawillalsodecline,aprocessthatwillcontinueatadiminishingrateuntilanewsteady-statelevelisreachedaty1.Thegrowthrateofoutputwillgraduallyadjusttothenewandhigherleveln1.yy*y1tot1tkk*k1tot1t6.a.AssumetheproductionfunctionisoftheformY=F(K,N,Z)=AKaNbZc==>DY/Y=DA/A+a(DK/K)+b(DN/N)+c(DZ/Z),witha+b+c=1.Nowassumethatthereisnotechnologicalprogress,thatis,DA/A=0,andthatcapitalandlaborgrowatthesamerate,thatis,DK/K=DN/N=n.Ifwealsoassumethatallnaturalresourcesavailablearefixed,suchthatDZ/Z=0,thentherateofoutputgrowthwillbe12nDY/Y=an+bn=(a+b)n.Inotherwords,outputwillgrowataratelessthannsincea+b<1.Thereforeoutputperworkerwillfall.6.b.Ifthereistechnologicalprogress,thatis,DA/A>0,thenoutputwillgrowfasterthanbefore,namelyDY/Y=DA/A+(a+b)n.IfDA/A>c,thenoutputwillgrowataratelargerthann,inwhichcaseoutputperworkerwillincrease.6.c.Ifthesupplyofnaturalresourcesisfixed,thenoutputcanonlygrowataratethatissmallerthantherateofpopulationgrowthandweshouldexpectlimitstogrowthaswerunoutofnaturalresources.However,iftherateoftechnologicalprogressissufficientlylarge,thenoutputcangrowataratefasterthanpopulation,evenifwehaveafixedsupplyofnaturalresources.7.a.IftheproductionfunctionisoftheformY=K1/2(AN)1/2,andAisnormalizedto1,thenwehaveY=K1/2N1/2.Inthiscasecapital'sandlabor'ssharesofincomeareboth50%.7.b.ThisisaCobb-Douglasproductionfunction.7.c.Asteady-stateequilibriumisreachedwhensy=(n+d)k.FromY=K1/2N1/2==>Y/N=K1/2N-1/2==>y=k1/2==>sk1/2=(n+d)k==>k-1/2=(n+d)/s=(0.07+0.03)/(.2)=1/2==>k1/2=2=y==>k=4.8.a.Iftechnologicalprogressoccurs,thenthelevelofoutputpercapitaforanygivencapital-laborratioincreases.Thefunctiony=f(k)increasestoy=g(k),andthusthesavingsfunctionincreasesfromsf(k)tosg(k).yg(k)y2f(k)12(n+d)ksg(k)y1sf(k)0k1k2k8.b.Sinceg(k)>f(k),itfollowsthatsg(k)>sf(k)foreachlevelofk.Thereforetheintersectionofthesg(k)-curvewiththe(n+d)k-lineisatahigherlevelofk.Thenewsteady-stateequilibriumwillnowbeatahigherlevelofsavingandoutputpercapita,andatahighercapital-laborratio.31n8.c.Afterthetechnologicalprogressoccurs,thelevelofsavingandinvestmentwillincreaseuntilanewandhigheroptimalcapital-laborratioisreached.Theratioofinvestmenttocapitalwillalsoincreaseinthetransitionperiod,sincemorehastobeinvestedtoreachthehigheroptimalcapital-laborratio.kk2k10t1t2t9.TheCobb-DouglasproductionfunctionisdefinedasY=F(N,K)=AN1-qKq.ThemarginalproductoflaborcanthenbederivedasMPN=(DY)/(DN)=(1-q)AN-qKq=(1-q)AN1-qKq/N==(1-q)(Y/N)==>labor'sshareofincome=[MPN*(N)]/Y=(1-q)(Y/N)*[(N)/(Y)]=(1-q)CHAPTER4GROWTHANDPOLICYSolutionstotheProblemsintheTextbookConceptualProblems:1.Endogenousorself-sustainedgrowthsupposedlycanbeachievedbypoliciesthataffectanation'ssavingsrateandthereforetheproportionofGDPthatgoestowardsinvestment.TheneoclassicalgrowthmodelofChapter3predictedthatlong-termgrowthcanonlybeachievedthroughtechnologicalprogressandthatchangesinthesavingsratehaveonlytransitoryeffects.Theendogenousgrowthmodel,however,predictsthatcountrieswithahighersavingsratecanachievehigherlong-termgrowthandthatanation'sgovernmentcanaffectthelong-termgrowthratebyimplementingpoliciesthataffectthesavingsrate.2.Asimplemodelwithconstantreturnstoscaletocapitalaloneimpliesincreasingreturnstoscaletoallfactorstakentogether,whichcouldcauseasinglelargefirmtodominatetheeconomy.However,suchamodelignoresthepossibilitythatexternalreturnstocapitalexist,inadditiontotheinternal(private)returns.Inotherwords,moreinvestmentnotonlyleadstoahigherandmoreefficientcapitalstockbutalsotonewideasandnewwaysofdoingthings,whichcanthenbecopiedbyothers.Therefore,asinglefirmdoesnotnecessarilyreapallofthebenefitsofincreasedoutput.3.Intheneoclassicalgrowthmodel,anincreaseinthesavingsratedoesnotincreasethelong-termgrowthrateofoutput.However,becauseoftheshort-runadjustmentprocess,thereissometransitionalgainthatwillleadtoahigherlevelofoutputpercapita.Intheendogenousgrowthmodel,however,thesavingsratedoesaffectthelong-termgrowthrateofoutput.4.a.Chapter4suggeststhatthekeytolong-termeconomicgrowthisinvestmentinhumanandphysicalcapitalwithparticularemphasisonresearchanddevelopment.4.b.(i)Investmenttaxcreditsmaypotentiallyaffecteconomicgrowthinthelongrunbyachievingahigherrateoftechnologicalprogress.31n(ii)R&Dsubsidiesandgrantsleadtotechnologicaladvancesthatwillhaveprivateandsocialreturns.Theyareveryeffectiveinstimulatinglong-termeconomicgrowth.(iii)Accordingtotheendogenousgrowthmodel,policiesdesignedtoincreasethesavingsratewillincreasethelong-termgrowthrateofoutput.However,empiricalevidencedoesnotlendmuchsupporttothatnotion.(iv)Increasedfundingforprimaryeducationhaslargeprivateandsocialreturnsandisthereforeanexcellentmeanstostimulatelong-termgrowth,eventhoughitmaytakealongtimeuntilthesepolicieshavetheirfulleffect.5.Thenotionofabsoluteconvergencestatesthateconomieswiththesamesavingsrateandrateofpopulationgrowthwillreachthesamesteady-stateequilibriumiftheyhaveaccesstothesametechnology.Thenotionofconditionalconvergencestatesthateconomiesthathaveaccesstothesametechnologyandthesamerateofpopulationgrowthbutdifferentsavingsrateswillreachsteady-stateequilibriaatadifferentlevelofoutputbutthesameeconomicgrowthrate.Thereisempiricalevidencetosupportthenotionofconditionalconvergenceacrosscountries.6.Endogenousgrowththeoryassumesthatthesteady-stategrowthrateofoutputisaffectedbytherateatwhichthefactorsofproductionareaccumulated.Therefore,anincreaseinthesavingsratewouldincreasetherateatwhichthecapitalstockisaccumulatedandthiswouldincreasethegrowthrateofoutput.Whilethisnotionmaybeimportantinexplainingthegrowthratesofhighlydevelopedcountriesattheleadingedgeoftechnology,itcannotexplainthedifferencesingrowthratesacrosspoorercountries.Forthesecountries,thenotionofconditionalconvergenceseemstohold.7.Investinginphysicalcapitalwillleadtoahighercapitalstockandtoahigherlevelofoutputintheshortrun,butoftentothedetrimentoflong-termgrowthunlesstherearesignificantexternalreturnstocapital.Therefore,investinginhumancapitalisabetterstrategy,sinceithashighreturnsandleadstoanincreaseinlong-termgrowth.8.a.Acountrythatisabletochooseitsrateofpopulationgrowththroughpopulationcontrolpoliciescanshifttheinvestmentrequirementdown,therebyincreasingthelevelofsteady-stateoutput.Withalowerrateofpopulationgrowthitispossibletoachieveahigherlevelofincomepercapitawithalowerlevelofinvestmentspending.Therefore,implementingpopulationcontrolpoliciesmaybeaneffectivewaytoescapetheso-calledpovertytrap.8.b.Inanendogenousgrowthmodel,alowerpopulationgrowthrate(n)willincreaseanation'slong-termgrowthrate(Dy/y).Wecanseethissince,inthesecondoptionalsection,theper-capitagrowthratewasderived,asfollows:Dy/y=sa-(n+d).31n9.TheAsianTigers(HongKong,Singapore,SouthKorea,andTaiwan)experiencedahighrateofeconomicgrowthbetween1966and1990byconcentratingonimprovingtheeducationofthepopulationandincreasingthesavingsrate,assuggestedbytheendogenousgrowthmodel.However,increasesinthelaborforcesofthesecountriessuggestedbytheneoclassicalgrowthmodel,werealsoatwork.10.ThedeclineinlivingstandardsexperiencedbyEasternEuropeancountriesintransitionfromcentrallyplannedeconomiestofreemarketeconomiescannoteasilybeexplainedbyneoclassicalorendogenousgrowththeory.ThedeclineinGDPinthesecountrieswaslargelyduetodisorganizedmarketsthatlackedproperlyassignedpropertyrightsorliabilityrulesandaninsufficientlydevelopedbankingsystem.Inaddition,theneedforlarge-scalereplacementofoutdatedproductiontechnologycausedfurtherdisruption.11.Inisunclearwhethercountriescanactuallyexperienceindefiniteincreasesintheirgrowthpotential.However,iftechnologicaladvancesoccurcontinuouslyandifintelligentresourcemanagementispracticed,itisconceivablethateconomicgrowthwillcontinueforavery,verylongtime.TechnicalProblems:1.a.Aproductionfunctionthatdisplaysbothadiminishingandaconstantmarginalproductofcapitalcanbedisplayedbydrawingacurvedline(asinanexogenousgrowthmodel),followedbyaupward-slopingline(asinanendogenousgrowthmodel).Suchagraphisdepictedbelow.1.b.Thefirstequilibrium(PointAinthegraphbelow)isastablelow-incomesteady-stateequilibrium.Anydeviationfromthatpointwillcausetheeconomytoeventuallyadjustagainatthesamesteady-stateincomelevel(andcapital-outputratio).Thesecondequilibrium(PointB)isanunstablehigh-incomesteady-stateequilibrium.Anydeviationfromthatpointwillleadtoeitheralowerincomesteady-stateequilibrium(ifthecapital-laborratiodeclines)orongoinggrowth(ifthecapital-laborratioincreases).yy=f(k)yBsyB(n+d)kyAA31n0kAkBk1.c.Amodelliketheoneinthisquestioncanbeusedtoexplainhowsomecountriescanfindthemselvesinasituationwithnogrowthandlowincomewhileothershaveongoinggrowthandahighlevelofincome.Inthefirstcase,acountrymayhaveinvestedinphysicalcapital,leadingtosomeshort-termgrowthattheexpenseoflong-termgrowth,whereasinthesecondcase,acountrymayhaveinvestedheavilyinhumancapital,reapingsignificantsocialreturns.2.a.Ifpopulationgrowthisendogenous,thatis,ifacountrycaninfluencetherateofpopulationgrowththroughgovernmentpolicies,thentheinvestmentrequirementisnolongerastraightline.Insteaditiscurvedasdepictedbelow.yyCy=f(k)yB[n(y)+d]]kCsf(k)yABA0kAkBkCk2.b.Thefirstequilibrium(PointA)isastablesteady-stateequilibrium.Itisasituationoflowincomeandhighpopulationgrowth,indicatingthatthecountryisinapovertytrap.Thesecondequilibrium(PointB)isanunstablesteady-stateequilibrium.Itisasituationofmediumincomeandlowpopulationgrowth.Thethirdequilibrium(PointC)isastablesteady-stateequilibrium.Itisasituationofhighincomeandlowpopulationgrowth.Noneofthesethreeequilibriahaveongoinggrowth.2.c.Toescapethepovertytrap(PointA),acountryhasseveralpossibilities:First,itcansomehowfindthemeanstoincreasethecapital-laborratioabovealevelconsistentwithPointB(perhapsbyborrowingfundsorseekingdirectforeigninvestment).Second,itcanincreasethesavingsratesuchthatthesavingsfunctionnolongerintersectstheinvestmentrequirementcurveateitherPointAorPointB.Third,itcandecreasetherateofpopulationgrowththroughspecificallydesignedpolicies,suchthattheinvestmentrequirementshiftsdownandnolongerintersectswiththesavingsfunctionatPointAorPointB.3.a.Ifweincorporateendogenouspopulationgrowthintoatwo-sectormodelinProblem2,thenwegetacurvedlinefortheinvestmentrequirementlineandaproductionfunctionwithfirstadiminishingand31nthenaconstantmarginalproductofcapitalasdepictedbelow.(Notethatthesavingsfunctionhasthesameshapeastheproductionfunction.)yy=f(k)yDsf(k)D[n+d)]kyCyByACBA0kAkBkCkDk3.b.Thereshouldbefourintersectionsofthesavingsfunctionandtheinvestmentrequirement.Thefirstequilibrium(atPointA)isastablelow-incomesteady-stateequilibrium.Anydeviationfromthatpointwillcausetheeconomytoeventuallyadjustagainatthesamesteady-stateincomelevel(andcapital-outputratio).Thesecondequilibrium(atPointB)isanunstablelow-incomeequilibrium.Anydeviationfromthatpointwillleadtoeitheralowerincomesteady-stateequilibriumatPointA(ifthecapital-laborratiodeclines)orahigherincomesteady-stateequilibriumatPointC(ifthecapital-laborratioincreases).PointDisagainanunstableequilibriumbutatahighlevelofincome.Anydeviationfromthatpointwillleadtoeitheralowerincomesteady-stateequilibriumatPointC(ifthecapital-laborratiodeclines)orongoinggrowth(ifthecapital-laborratioincreases).3.c.Thismodelismoreinclusivethaneitherofthetwomodelsdiscussedpreviously,andthereforehasgreaterexplanatorypower.Butnowthegraphicalanalysisisfarmorecomplicated.Itmaynotbeworththeefforttointroducesuchcomplications.4.a.TheproductionfunctionisoftheformY=K1/2(AN)1/2=K1/2(4[K/N]N)1/2=K1/2(4K)1/2=2K4.b.Sincea=y/k=2,itfollowsthatthegrowthrateofoutputisg=sa-(n+d)=(0.1)2-(0.02+0.03)=0.15=15%.4.c.Theterm"a"intheequationabovestandsforthemarginalproductofcapital.Ifweassumethattheleveloflabor-augmentingtechnology(A)isproportionaltothecapital-laborratio(k),weimplythattheleveloftechnologydependsontheamountofcapitalperworkerthatwehave,whichmaynotberealistic.4.d.Inthismodel,wehaveaconstantmarginalproductofcapital,andthereforewehaveanendogenousgrowthmodel.31n5.a.TheproductionfunctionisoftheformY=K1/2N1/2==>Y/N=(K/N)1/2==>y=k1/2.Fromk=sy/(n+d)=sk1/2/(n+d)==>k1/2=s/(n+d)==>y*=s/(n+d)=(0.1)/(0.02+0.03)=2==>k*=sy*/(n+d)=(0.1)(2)/(0.02+0.03)=45.b.Steady-stateconsumptionequalssteady-stateincomeminussteady-stateinvestment,thatis,c*=f(k*)-(n+d)k*.Thegoldenrulecapitalstockcorrespondstothehighestpermanentlysustainablelevelofconsumption.Steady-stateconsumptionismaximizedwhenthemarginalincreaseincapitalproducesjustenoughextraoutputtocovertheincreasedinvestmentrequirement.Fromc=k1/2-(n+d)k==>(Dc/Dk)=(1/2)k-1/2-(n+d)=0==>k-1/2=2(n+d)=2(.02+.03)=.1==>k1/2=10==>k=100Sincek*=4<100,wehavelesscapitalatthesteadystatethanthegoldenrulesuggests.5.c.Fromk=sy/(n+d)=sk1/2/(n+d)==>s=k1/2(n+d)=10(0.05)=.55.d.Ifwehavemorecapitalthanthegoldenrulesuggests,thenwearesavingtoomuchandwedonothavetheoptimalamountofconsumption.Chapter5SolutionstotheProblemsintheTextbookConceptualProblems:1.Theaggregatesupplycurveshowsthequantityofrealtotaloutputthatfirmsarewillingtosupplyateachpricelevel.Theaggregatedemandcurveshowsallcombinationsofrealtotaloutputandthepricelevelatwhichthegoodsandthemoneysectorsaresimultaneouslyinequilibrium.AlongtheAD-curvenominalmoneysupplyisassumedtobeconstantandnofiscalpolicychangetakesplace.2.Theclassicalaggregatesupplycurveisvertical,sincetheclassicalmodelassumesthatnominalwagesadjustveryquicklytochangesinthepricelevel.Thisimpliesthatthelabormarketisalwaysinequilibriumandoutputisalwaysatthefull-employmentlevel.IftheAD-curveshiftstotheright,firmstrytoincreaseoutputbyhiringmoreworkers,whotheytrytoattractbyofferinghighernominalwages.Butsincewearealreadyatfullemployment,nomoreworkerscanbehiredandfirmsmerelybidupnominalwages.Thenominalwageincreaseispassedonintheformofhigherproductprices.Intheend,thelevelofwagesandpriceswillhaveincreasedproportionally,whiletherealwagerateandthelevelsofemploymentandoutputwillremainunchanged.Ifthereisadecreaseindemand,thenfirmstrytolayoffworkers.Workers,inturn,arewillingtoacceptlowerwagestostayemployed.Lowerwagecostsenablefirmstolowertheirproductprices.Intheend,nominalwagesandpriceswilldecreaseproportionallybuttherealwagerateandthelevelofemploymentandoutputwillremainthesame.3.Thereisnosingletheoryoftheaggregatesupplycurve,whichshowstherelationshipbetweenfirms'outputandthepricelevel.Anumberofcompetingexplanationsexistforthefactthatfirmshaveatendencytoincreasetheiroutputlevelasthepricelevelincreases.TheKeynesianmodelofahorizontalaggregatesupplycurvesupposedlydescribestheveryshortrun(overaperiodofafewmonthsorless),whiletheclassicalmodelofaverticalaggregatesupplycurveissupposedtoholdtrueforthelongrun(aperiodofmorethan10years).Themedium-runaggregatesupplycurveismostusefulforperiodsofseveralquartersorafewyears.Thisupward-slopingaggregatesupplycurveresultsfromthefactthatwageandpriceadjustmentsareslowanduncoordinated.Chapter6offersseveralexplanationsforthefactthatlabormarketsdonotadjustquickly.Theseincludethe31nimperfectinformationmarket-clearingmodel,theexistenceofwagecontractsorcoordinationproblems,andthefactthatfirmspayefficiencywagesandpricechangestendtobecostly.4.TheKeynesianaggregatesupplycurveishorizontalsincethepricelevelisassumedtobefixed.Itismostappropriatefortheveryshortrun(aperiodofafewmonthsorless).Theclassicalaggregatesupplycurveisverticalandoutputisassumedtobefixedatitspotentiallevel.Itismostappropriateforthelongrun(aperiodofmorethan10years)whenpricesareabletofullyadjusttoallshocks.5.Theaggregatesupplyandaggregatedemandmodelusedinmacroeconomicsisnotverysimilartothemarketdemandandmarketsupplymodelusedinmicroeconomics.Whiletheworkingsofbothmodels(thedistinctionbetweenshiftsofthecurvesversusmovementalongthecurves)aresimilar,thesemodelsarereallyunrelated.The"P"inthemicroeconomicmodelstandsfortherelativepriceofagood(ortheratioatwhichtwogoodsaretraded),whereasthe"P"inthemacroeconomicmodelstandsfortheaveragepricelevelofallgoodsandservicesproducedinthiscountry,measuredinmoneyterms.TechnicalProblems:1.a.AsFigure5-9inthetextshows,adecreaseinincometaxeswillshiftboththeAD-curveandtheAS-curvetotheright.TheshiftintheAD-curvetendstobefairlylargeand,intheshortrun(whenpricesarefixed),leadstoasignificantincreaseinoutputwithoutachangeinprices.Inthelongrun,theAS-curvewillalsoshifttotheright--sincelowerincometaxratesprovideanincentivetoworkmore--butonlybyafairlysmallamount.ThereforeweseeaslightlyhigherrealGDPwithalargeincreaseinthepricelevelinthelongrun.1.b.Supply-sideeconomicsisanypolicymeasurethatwillincreasepotentialGDPbyshiftingthelong-run(vertical)AS-curvetotheright.Intheearly1980s,supply-sideeconomistsputforththeviewthatacutinincometaxrateswouldincreasetheincentivetowork,saveandinvest.Thiswouldincreaseaggregatesupplysomuchthattheinflationandunemploymentrateswouldsimultaneouslydecrease.Theresultinghigheconomicgrowthmightthenevenleadtoanincreaseintaxrevenues,despitelowertaxrates.However,thesepredictionsdidnotbecomereality.Asseenintheanswerto2.a.,thelong-runeffectofataxcutonoutputisnotverylarge,althoughitcanincreaselong-termoutputtosomedegree.2.a.Accordingtothebalancedbudgettheorem,asimultaneousandequalincreaseingovernmentpurchasesandtaxeswillshifttheAD-curvetotheright.ButiftheAS-curveisupwardsloping,thenthebalancedbudgetmultiplierwillbelessthanone,thatis,theincreaseinoutputwillbelessthantheincreaseingovernmentexpenditures.Thisoccurs,sincepartoftheincreaseingovernmentspendingwillbecrowdedoutdueahigherpricelevel,lowerrealmoneybalances,andaresultingriseininterestrates.PADoAD1ASPoP1031nYoY1Y2.b.IntheKeynesiancase,theAS-curveishorizontalandthepricelevelremainsunchanged.Thereisnorealbalanceeffectandthereforeincomewillincreasemorethanin3.a.However,theinterestratewillstillincreaseandthereforethebalancedbudgetmultiplierwillbelessthanone(butgreaterthanzero).PADoAD1PoAS0YoY1Y2.c.Intheclassicalcase,theAS-curveisverticalandtheoutputlevelremainsunchanged.Inthiscase,ashiftintheAD-curveleadstoapriceincreaseandrealmoneybalancesdecline.Thereforeinterestratesincreasefurtherthanin3.b.,leadingtofullcrowdingoutofinvestment.Hencethebalancedbudgetmultiplieriszero.PAD1ASAD0P1P00Y*YAdditionalProblems1.BrieflyexplainwhytheAS-curveisupwardslopingintheintermediaterun?Anupward-slopingAS-curveassumesthatwageandpriceadjustmentsareslowanduncoordinated.Thiscanbeexplainedmosteasilybytheexistenceofwagecontractsandimperfectcompetition.Becauseofwagecontracts,wagescannotbechangedeasilyand,sincethecontractstendtobestaggered,theycannotbechangedallatonce.Inanimperfectlycompetitivemarketstructure,firmsarereluctanttochangetheirpricessincetheycannotaccuratelypredictthereactionsoftheircompetitors.Therefore,wagesandpriceswilladjustonlyslowly.(Chapter6providesmoreelaborateexplanationsforthis.)2.BrieflydiscussinwordswhytheAD-curveisdownwardsloping.IntheAD-ASframework,weassumethatnominalmoneysupply(M)isconstantunlessitischangedbytheFed'smonetarypolicy(whichwouldresultinashiftintheAD-curve).Therefore,ifthepricelevelincreases,thenrealmoney(M/P)decreases,drivinginterestrates(i)upandloweringthelevelofinvestmentspending(I).Thismeansthattotaloutputdemanded(Y)willdecrease.31nAmoreelaborateanswermayincludethatlowerrealmoneybalances(M/P)resultinlessrealwealth,leadingtoalowerlevelofconsumption(C)duetothewealtheffect.Thismeansthattotaloutputdemanded(Y)willdecrease.Ahigherdomesticpricelevel(P)alsomeansthatdomesticgoodswillbecomelesscompetitiveinworldmarkets.Thiswillstimulateimportswhilereducingexports,leadingtoareductioninnetexports(NX),andadecreaseintotaloutputdemanded(Y).3."Intheclassicalaggregatesupplycurvemodel,theeconomyisalwaysatthefull-employmentlevelofoutputandtheunemploymentrateisalwayszero."Commentonthisstatement.TheclassicalaggregatesupplycurvemodelimpliesaverticalAS-curveatthefull-employmentlevelofoutput.However,thisdoesnotmeanthattheunemploymentrateiszero.Thereisalwayssomefrictioninthelabormarket,whichmeansthatthereisalwayssome(frictional)unemploymentasworkersswitchjobs.The(positive)amountofunemploymentatthefull-employmentlevelofoutputiscalledthenaturalrateofunemploymentandisestimatedtoberoughly5.5percentfortheUnitedStates;however,anexactvalueforthisnaturalratehasnotbeenestablished.4.Assumeatechnologicaladvanceleadstolowerproductioncosts.Showtheeffectofsuchaneventonnationalincome,unemployment,inflation,andinterestrateswiththehelpofanAD-ASdiagram,assumingcompletelyflexiblewagerates.AdecreaseinproductioncostsshiftstheAS-curvetotheright.Thepriceleveldecreases,leadingtoahigherlevelofincomeandlowerinterestrates.Sincewagesarecompletelyflexible,theAS-curveisverticalandwearealwaysatfull-employment(thisistheclassicalcase).Thisimpliesthattheunemploymentratestaysatthenaturalrate,butoutputgoesupsinceworkersarenowmoreproductive.1.®2.Costofprod.==>AS®Ex.S.==>P¯realmsi¯IYEffect:YUR¯P¯i¯PASoAS1Po31nP1AD0YoFEY1FEY5."MonetaryexpansionwillnotchangeinterestratesintheclassicalAS-curvemodel."Commentonthisstatement.AnincreaseinthenominalmoneysupplywillshifttheAD-curvetotheright.Therewillbeexcessdemandforgoodsandservices,whichwillforcethepricelevelup.IntheclassicalAS-curvemodel,anewequilibriumwillbeestablishedatthesamelevelofoutputbutatahigherpricelevel.Realmoneybalanceswillbereducedtotheiroriginallevelandinterestrateswillnotbeaffectedinthelongrun(theclassicalcase).6."ExpansionaryfiscalpolicydoesnotaffectthelevelofrealoutputorrealmoneybalancesintheclassicalAS-curvecase."Commentonthisstatement.ExpansionaryfiscalpolicywillshifttheAD-curvetotheright,causingexcessdemandforgoodsandservicesattheexistingpricelevel.Thisforcesthepricelevelup,reducingrealmoneybalances.Interestratesincrease,whichresultsinalowerlevelofinvestmentspending.Intheclassicalcase,theAS-curveisvertical,sothelevelofoutputwillnotchange.Inotherwords,theincreaseinthelevelofpricesandinterestratescontinuesuntilprivatespendingisreducedagaintotheoriginalfull-employmentlevel.7."IntheclassicalAS-curvecase,areductioningovernmentspendingwilllowerinterestratesandtherealmoneystock."Commentonthisstatement.AdecreaseingovernmentspendingwillshifttheAD-curvetotheleft,causingexcesssupplyofgoodsandservicesattheoriginalpricelevel.Asthepriceleveldecreasestorestoreequilibrium,realmoneybalancesincreaseandinterestratesfall.Thiswillincreasethelevelofinvestmentspendinguntilanewequilibriumisreachedattheoriginallevelofoutputbutatlowerpricesandinterestrates.Thus,realmoneybalanceswillrise,butinterestratesfall.8."IntheKeynesianaggregatesupplycurvemodel,theFed,throughrestrictivemonetarypolicy,caneasilylowerinflationwithoutcreatingunemployment."Commentonthisstatement.Thisstatementiswrong.IntheKeynesianaggregatesupplycurvemodel,theAS-curveishorizontal,sincepricesareassumedtobefixed.RestrictivemonetarypolicywillshifttheAD-curvetotheleft.Thiswillreducethelevelofoutputwithoutanychangeinthepricelevel.Butalowerlevelofoutputimpliesahigherrateofunemployment.9.Trueorfalse?Why?"MonetarypolicydoesnotaffectrealoutputintheKeynesiansupplycurvemodel."False.AnincreaseinmoneysupplywillshifttheAD-curvetotheright,leadingtoahigherlevelofincome.IntheKeynesiansupplycurvemodel,thepricelevelisfixed,hencerealbalanceswillnot31nfallastheywouldintheclassicalsupplycurvemodel.Wewillreachanewequilibriumatahigherlevelofoutput,atalowerinterestrate,butatthesamepricelevel.Inthiscasemonetarypolicyisnotneutral.10.ExplainwhythereissomuchinterestinfindingwaystoshifttheAS-curvetotheright.ShiftingtheAS-curvetotherightseemstobetheonlywaytooffsettheeffectsofanadversesupplyshockwithoutnegativesideeffects.Anadversesupplyshock,suchasanincreaseinoilprices,causesasimultaneousincreaseinunemploymentandinflation,andpolicymakershaveonlytwooptionsfordemand-managementpolicies.Expansionaryfiscalormonetarypolicywillhelptoachievefullemploymentfasterbutwillraisethepricelevel,whilerestrictivefiscalormonetarypolicywillreduceinflationarypressurebutincreaseunemployment.Therefore,anypolicythatwouldshifttheshort-runAS-curvebacktotherightseemspreferable,sinceitmightbringtheeconomybacktotheoriginalequilibriumbysimultaneouslyloweringinflationandunemployment.11."Restrictivefiscalpolicywillalwaysloweroutput,prices,andinterestrates."Comment.ThisstatementistrueintheintermediaterunwhentheAS-curveisupwardsloping.RestrictivefiscalpolicywillshifttheAD-curvetotheleft.IntheKeynesiancase,theAS-curveishorizontalandpricesremainconstant,whilebothoutputandinterestratesdecrease.Intheclassicalcase,theAS-curveisverticalandthedecreaseinthepricelevelwillincreaserealmoneybalancesandinterestrates.Priceswillfalluntilspendingisagainconsistentwiththefull-employmentlevelofoutput.Thusinthelongrun,pricesandinterestrateswilldecline,whileoutputwillremainthesame.Onlyintheintermediaterun(whentheAS-curveisupwardslopingduetoslowlyadjustingwagesandprices)willoutput,prices,andtheinterestrateallgodown.12."Therealimpactofdemandmanagementpolicyislargelydeterminedbytheflexibilityofwagesandprices."Commentonthisstatement.Ifwagesandpricesarecompletelyflexible,thentheeconomywillalwaysbeatthefull-employmentlevelofoutput,independentofthepricelevel.Inotherwords,wehavetheclassicalcaseofavertical(long-run)AS-curve.Inthiscase,ashiftintheAD-curvewillaffectonlythepricelevelbutnotthelevelofoutput.However,ifwagesandpricesarecompletelyinflexible,thenwehavethe(horizontal)Keynesianaggregatesupplycurve.Inthiscase,anyshiftoftheAD-curvewillhavealargeeffectonthelevelofoutputbutwillnotaffectthepricelevel.Onlyintheintermediaterun,whenwehaveanupward-slopingAS-curve,willthelevelofoutputandthepricelevelbothbeaffectedbyashiftintheAD-curve.MoreflexibilityinwagesandpricesimpliesasteepertheAS-curve.ThereforetheeffectofashiftintheAD-curvewillbesmalleronoutputandlargeronthepricelevel.13."Anincreaseintheincometaxratewilllowerthelevelofoutputandincreasethepricelevel."Commentonthisstatement.SupplysidersarguethatadecreaseinincometaxeswillshiftboththeAD-curveandtheAS-curvetotheright(asshowninFigure5-10).Conversely,anincreaseintheincometaxratewillshifttheAD-curveandtheAS-curvetotheleft.TheshiftintheAD-curvewillbefairlylargeand,inthemediumrun,willleadtoasignificantdecreaseinoutputwithouta(significant)changeinthepricelevel.However,inthelongrun,theAS-curvewillalsoshifttotheleft,sincehigherincometaxratesprovideadisincentiveto31nwork.SincetheAS-curvewillshiftonlybyafairlysmallamount,wewillseeaslightlylowerrealGDPwithalargedecreaseinthepricelevel.Chapter6SolutionstotheProblemsintheTextbook:ConceptualProblems:1.TheaggregatesupplycurveandthePhillipscurvedescribeverysimilarrelationshipsandbothcurvescanbeusedtoanalyzethesamephenomena.TheAS-curveshowsarelationshipbetweenthepricelevelandthelevelofoutput.ThePhillipscurveshowsarelationshipbetweentherateofinflationandtheunemploymentrate,givencertaininflationaryexpectations.Forexample,amovementalongtheAS-curvedepictsanincreaseinthepricelevelthatisassociatedwithanincreaseinthelevelofoutput.Asoutputincreases,therateofunemploymentdecreases(seeOkun’slaw).Therefore,withalargerincreaseinthepricelevel(ahigherlevelofinflation)therewillbeadecreaseinunemployment,creatingadownward-slopingPhillipscurve.ThisdownwardslopingPhillipscurveshiftswheneverinflationaryexpectationschange.Ifoneassumesthatworkerswillchangetheirwagedemandswhenevertheirinflationaryexpectationschange,onecanconcludethatashiftinthePhillipscurvecorrespondstoashiftintheupwardslopingAS-curve,sincehigherwagesmeanhighercostofproduction.2.Intheshortrun,whenwagesandpricesareassumedtobefixed,therecanbenoinflationandthusthePhillipscurvemakesnosenseoverthisverybrieftimeframe.Butinthemediumrun(inthischapteralsooftenreferredtoastheshortrun),thePhillipscurveisdownwardslopingasinflationaryexpectationsareassumedtobeconstant.Inthelongrun,thePhillipscurveisverticalatthenaturalrateofunemployment,whichcorrespondstotheverticallong-runAS-curveatthefull-employmentlevelofoutput.3.Avarietyofexplanationsaregiveninthischapterforthestickinessofwagesintheshortorintermediaterun.Oneisthatworkershaveimperfectinformationandnobodyknowstheactualpricelevel.Peopledon’tknowwhetherachangeintheirnominalwageistheresultofanincreaseinpricesorintherealwagetheyreceivefortheworktheyprovide.Duetothisuncertainty,labormarketswillnotclearimmediately.Anotherargumentreliesoncoordinationproblems,thatis,differentfirmswithinaneconomycannotcoordinatepricechangesinresponsetomonetarypolicychanges.Individualfirmschangetheirpricesonlyreluctantly,sincetheyareafraidoflosingmarketshare.Theefficiencywagetheoryarguesthatemployerspayabovemarket-clearingwagestomotivatetheirworkerstoworkharder.Firmsarealsoreluctanttochangewagesbecauseoftheperceivedmenucostsinvolved.Therearelong-termrelationsbetweenfirmsandworkersandwagesareusuallysetinnominaltermsbywagecontracts,whicharerenegotiatedonlyperiodically.Thusrealwagesfluctuateovertimeasthepricelevelchanges.Finally,theinsider-outsidermodelarguesthatfirmsnegotiateonlywiththeirownemployeesbutnotwithunemployedworkers.Sinceaturnoverinthelaborforce31niscostlytofirms,theyarewillingtoofferabovemarket-clearingwagestothecurrentlyemployedratherthanhiringtheunemployedwhomaybewillingtoworkforlowerwages.Thesedifferentviewsarenotnecessarilymutuallyexclusiveanditisuptostudentstodecidewhichoftheargumentspresentedheretheyfindmostplausible.Theexplanationsdiffermainlyintheirassumptionofhowfastmarketsclearandwhetheremploymentvariationsarevoluntary.4.a.Stagflationisdefinedasaperiodofhighunemploymentaccompaniedbyhighinflation.4.b.Stagflationcanoccurintimeperiodswhenpeoplehavehighinflationaryexpectations.Iftheeconomygoesintoarecession,theactualrateofinflationwillfallbelowtheexpectedrateofinflation.However,theactualinflationratemaystillbeveryhighwhiletherateofunemploymentisincreasing.Forexample,theFedmayhaveletmoneysupplygrowmuchtoofastinthepast,soeveryoneexpectsahighinflationrate.Ifasupplyshockoccurs,wewillseeanincreaseintherateofunemploymentwhileinflationaryexpectationsandactualinflationremainveryhigh.Thisscenariooccurredduringthe1970s.Oncewehavereachedsuchasituation,itbecomesnecessarytodesignpoliciesthatwillreduceinflationaryexpectationstoshiftthePhillipscurvebacktotheleft.5.AssumeadisturbanceoccursandtheAD-curveshiftstotheright.Unemploymentdecreasesandinflationincreases,andwemovealongthedownwardslopingPhillipscurvetotheleft.However,assoonaspeoplerealizethatactualinflationishigherthantheirinflationaryexpectations,theyadjusttheirinflationaryexpectationsupwardandthedownward-slopingPhillipscurveshiftstotheright,eventuallyreturningunemployment31nbacktoitsnaturalrate.Inotherwords,theeconomyadjustsbackatthefull-employmentlevelofincome.Ifanadversesupplyshockoccurs(theupward-slopingAS-curveshiftstotheleft),unemploymentandinflationincreasesimultaneously.Thiswillcorrespondtoashiftofthedownward-slopingPhillipscurvetotheright.However,whenpeoplerealizethatactualinflationislessthanexpectedinflation,thenthedownward-slopingPhillipscurvestartstoshiftbackandtheeconomyadjustsbacktothenaturalrateofunemploymentinthelongrun.6.Theexpectations-augmentedPhillipscurvepredictsthatinflationwillriseabovetheexpectedlevelwhenunemploymentdropsbelowitsnaturalrate.However,ifpeopleknowthatthisisgoingtohappen,whydon’ttheyimmediatelyadjusttoit?Andifpeopleimmediatelyadjustedtoit,wouldn’tthisimplythatanticipatedmonetarypolicywouldbeineffectivetocauseanydeviationfromthefull-employmentlevelofoutput?Inreality,however,evenifpeoplehaverationalexpectations,theymaynotbeabletoadjustimmediately.Onereasonisthatwagecontractsoftensetwagesforanextendedtimeperiod.Similarly,pricescannotalwaysbechangedrightawayandthecostsofchangingpricesmayoutweighthebenefits.Afurtherargumentisthatevenrationalpeoplemakeforecastingmistakesandlearnonlyslowly.Inotherwords,thelocationoftheexpectations-augmentedPhillipscurveisdeterminedbythelevelofexpectedinflation,whichissetbyrecenthistoricalexperience.Ashiftinthiscurvecausedbychanginginflationaryexpectationsoccursonlygradually.Therationalexpectationsmodel,ontheotherhand,assumesthatthePhillipscurveshiftsalmostinstantaneouslyasnewinformationaboutthenearfuturebecomesavailable.TechnicalProblems:1.Areductioninthesupplyofmoneyleadstoexcessdemandformoneyandincreasedinterestrates,reducingthelevelofprivatespending(especiallyinvestment).ThereforetheAD-curveshiftstotheleft.Thiscausesanexcesssupplyofgoodsandservicesattheoriginalpricelevelsothepricelevelstartstodecrease.SincetheAS-curveisupwardsloping,anewshort-runmacro-equilibriumisreachedatalowerlevelofoutput(andthusahigherlevelofunemployment)andalowerpricelevel.PAD1AS1AS2AD231nP11P22P230Y1Y*YHowever,thehigherlevelofunemploymenteventuallyputsdownwardpressureonwages,reducingthecostofproductionandshiftingtheupward-slopingAS-curvetotheright.Alternatively,sincethisequilibriumoutputlevelisbelowthefull-employmentlevel,priceswillcontinuetofall,andtheupward-slopingAS-curvewillshifttotheright.Aslongasoutputisbelowthefull-employmentlevelY*,theupward-slopingAS-curvewillcontinuetoshifttotheright,whichmeansthatthepricelevelwillcontinuetodecline.Eventuallyanewlong-runequilibriumwillbereachedatthefull-employmentlevelofoutput(Y*)andalowerpricelevel.2.Accordingtotherationalexpectationstheory,anannouncedchangeinmonetarypolicywouldimmediatelychangepeople’sperceptioninregardtotheexpectedinflationrate.Ifpeoplecouldadjustimmediatelytothischangeininflationaryexpectations,thentherateofunemploymentortheoutputlevelwouldremainthesame.Inotherwords,wewouldimmediatelymovefrompoint1topoint3inthediagramusedtoexplainthepreviousquestionandtheFedwouldbeunabletoaffecttheunemploymentrate.Inreality,however,evenifpeoplehaverationalexpectationsandcananticipatetheeffectsofapolicychangecorrectly,theymaynotbeabletoimmediatelyadjustduetowagecontracts,etc.Thus,therewillalwaysbesomedeviationfromthefull-employmentoutputlevelY*.3.a.Afavorablesupplyshock,suchasadeclineinmaterialprices,shiftstheupward-slopingAS-curvetotheright,leadingtoexcesssupplyattheexistingpricelevel.Anewshort-runequilibriumisreachedatahigherlevelofoutputandalowerpricelevel.Butsinceoutputisnowabovethefull-employmentlevelY*,thereisupwardpressureonwagesandpricesandtheupward-slopingAS-curveshiftsbacktotheright.Anewlong-runequilibriumisreachedbackattheoriginalposition(Y*),andtheoriginalpricelevel(assumingthatthechangeinmaterialpricesdidnotaffectthefull-employmentlevelofoutput).Sincenominalwages(W)willhaverisenbutthepricelevel(P)willnothavechanged,realwages(W/P)willhaveincreased.31nPADAS1AS231P1P20Y*Y1Y3.b.Lowermaterialpriceslowerthecostofproduction,shiftingtheupward-slopingAS-curveshiftstotheright,andleadingtoanincreaseinoutputandalowerpricelevel.Sinceunemploymentisnowbelowitsnaturalrate,thereisashortageoflabor,providingupwardpressureonwages.Thiswillincreasethecostofproductionagain,eventuallyshiftingtheupward-slopingAS-curvebacktotheoriginallong-runequilibrium(assumingthatpotentialGDPhasnotbeenaffected).AdditionalProblems:1.Explainthelong-runeffectofanincreaseinnominalmoneysupplyontheamountofrealmoneybalancesavailableintheeconomy.Intheveryshortrun,thepricelevelisfixed,soifnominalmoneysupply(M)increases,ahigherlevelofrealmoneybalancesisavailable,causinginterestratestofallandthelevelofinvestmentspendingtoincrease.Thisleadstoanincreaseinaggregatedemand.TheshifttotherightoftheAD-curvecausesthepricelevel(P)toincrease,leadingtoareductioninrealmoneybalances(M/P).Inthemediumrun(anupward-slopingAS-curve),wereachanewequilibriumatahigheroutputlevelandahigherpricelevel.Sincepriceshavegoneupproportionallylessthannominalmoneysupply,realmoneybalanceshaveincreased.However,toreachanewlong-runequilibrium,priceshavetoincreasefurther,andasaresult,thelevelofrealmoneybalanceswilldecreasefurther.Whenthenewlong-runequilibriumatY*isfinallyreached,thepricelevelwillhaverisenproportionallytonominalmoneysupplyandthelevelofrealmoneybalanceswillbebackatitsoriginallevel.2.Assumetheeconomyisinarecession.Describeanadjustmentprocessthatwillensurethattheeconomyeventuallywillreturntofullemployment.Howcanthegovernmentspeedupthisprocess?31nIftheeconomyisinarecession,therewillbedownwardpressureonwagesandprices,whichwillbringtheeconomybacktothefull-employmentoutputlevel.Theupward-slopingAS-curvewillshifttotherightduetolowerproductioncosts.However,thisprocessmaytakeafairlylongtime.Thegovernmentcanshortenthisadjustmentprocesswiththehelpofexpansionaryfiscalormonetarypoliciestostimulateaggregatedemand.TheresultingshifttotherightoftheAD-curveimpliesthatthefinallong-runequilibriumwillbeatahigherpricelevel.Inotherwords,thereductioninunemploymentcanonlybeachievedatthecostofhigherinflation.3."Thestickinessofwagesimpliesthatpolicymakerscanachievelowunemploymentonlyiftheyarewillingtoputupwithhighinflation."Commentonthisstatement.Thereareseveralexplanationsofwhywagesandpricesadjustonlyslowly.Oneisthatworkershaveimperfectinformation,sotheydonotrealizethatlowerpricesmeanhigherrealwages.Anotheristhatfirmsarereluctanttochangepricesandwagessincetheyareunsureaboutthebehavioroftheircompetitorsandwanttoavoidtheperceivedcostofmakingthesechanges.Finally,wagecontractstendtobelong-termandstaggered,soittakestimetoadjustwagestopricechanges.Somefirmsmaypaytheirworkersabovemarket-clearingwagestokeepthemhappyandproductive.Forthesereasons,wagesandpricestendtoberigidintheshortrun.Thusittakestimefortheeconomytoadjustbacktofull-employment.IftherewereastablePhillips-curverelationship,alowrateofunemploymentcouldonlybeachievedbyallowinginflationtoincrease.However,suchastablerelationshipdoesnotexist.Wagestendtoberigidintheshortrun,soexpansionarypolicieslowerunemploymentandincreaseinflationintheshortrun.Inthelongrun,however,theeconomywilladjustbacktothenaturalrateofunemployment,soexpansionarypoliciessimplyleadtoahigherpricelevel.4."Ifweassumethatpeoplehaverationalexpectations,thenfiscalpolicyisalwaysirrelevant.Butmonetarypolicycanstillbeusedtoaffecttherateofinflationandunemployment."Commentonthisstatement.Individualsandfirmswithrationalexpectationsconsistentlymakeoptimaldecisionsbasedonallinformationavailable.Aslongasapolicychangeisanticipated,peopleareabletoassessitslong runoutcomeandwilltrytoimmediatelyadjust.Sincefiscalpolicydoesn'taffectinflationorunemploymentinthelongrun,itisalsoineffectiveintheshortrunifwagesandpricesareassumedtobeflexible.Ananticipatedchangeinmonetarygrowth,ontheotherhand,willbereflectedinachangeintheinflationrate.Ifwagesareflexible,workerswilladjusttheirwagedemandsimmediatelyandnosignificantchangeintheunemploymentratewilloccur.However,evenifpeoplehaverationalexpectations,wagestendtobefairlyrigidintheshortrunduetowagecontracts.Therefore,itwilltaketimefortheeconomytoadjustbacktoalong-runequilibrium.Thisimpliesthatbothfiscalandmonetarypolicycanaffecttherateofinflationandunemploymenttosomedegreeintheshortrun.5."Inflationcannotaccelerateinarecession,whentherateofunemploymentisaboveitsnaturalrate."Commentonthisstatement.Inflationcanaccelerateeveninarecession,thatis,whentheunemploymentishigh,ifasupplyshockoccurs.Anoilpriceincreasewillincreasethecostofproduction,sotheupward-slopingAS-curvewillshifttotheleft.Thiswillincreasetheinflationrateandtherateofunemploymentsimultaneously,asfirmsincreasetheirproductpricesandcuttheirproduction.IftheFedtriestoaccommodatethesupplyshockwithexpansionarymonetarypolicyinanefforttostimulatetheeconomy,theninflationwillaccelerateevenmore,astheAD-curveshiftstotheright.31n6.Commentonthefollowingstatement:"ThecoordinationapproachtothePhillipscurvefocusesontheproblemsthattheadministrationhasincoordinatingitsfiscalpolicieswiththemonetarypoliciesoftheFed."Thecoordinationapproachhasnothingtodowithfiscalormonetarypolicybutissimplyoneexplanationofwhywagesadjustslowly.Thisviewassertsthatfirmsgenerallyareunabletocoordinatewageandpricechangesinresponsetoamonetarypolicychange.Forexample,anyfirmthatcutsworkers'wagesinresponsetomonetarycontractionwhileotherfirmsdon't,willangeritsemployeeswhomaythenchoosetoleave.Firmsarealsoreluctanttochangetheirpricessincetheyareunsureabouttheircompetitors'behavior.Thuswagesandpriceschangeonlyslowlyinresponsetoachangeinaggregatedemand.Thisimpliesanupward-sloping(short-run)AS-curve.7.Commentonthefollowingstatement:"Theunemploymentrateiszeroatthefull-employmentlevelofoutput."Withahigherpricelevelrealwagesdecline,increasingthequantityoflabordemanded.Thereforethenominalwagerateisbidupuntiltherealwagerateisrestoredtoitsuniqueequilibriumlevel.Similarly,ifpricesfall,realwagesincrease,leadingtounemployment.Thenominalwageratefallstobringtherealwageratebacktoitsequilibriumlevel.Sothenominalwageratechangesinproportiontothepriceleveltomaintainarealwageratethatclearsthelabormarket.Atthiswagerate,thefull-employmentlevelofoutputisproduced.However,atthefull-employmentoutputleveltheunemploymentrateisnotzero.Duetofrictionsinthelabormarket,thereisalwaysapositiveunemploymentrate,asworkersswitchbetweenjobs.Thisiscalledthenaturalrateofunemployment.8.Brieflystatethereasonfortheslowadjustmentofwagestochangesinaggregatedemand.Thereasonsfortheslowadjustmentofnominalwagescanbeexplainedinseveralways.Oneexplanationisthatworkershaveimperfectinformation,thatis,theydonotimmediatelyrealizewhetherachangeintheirnominalwageistheresultofanincreaseinpricesorintherealwagetheyreceivefortheworktheyprovide.Anotherexplanationisthatcoordinationproblemsexist,thatis,differentfirmswithinaneconomyareunsureaboutthebehavioroftheircompetitorsandthustheyonlyreluctantlychangewagesorprices.Theefficiencywagetheory,ontheotherhand,arguesthatfirmspayabovemarket-clearingwagestomotivatetheirworkerstoworkharder.Firmsarealsoreluctanttochangewagesduetotheperceivedcostofdoingso.Anotherargumentisthatwagecontractstendtobelong-term,sorealwagestendtofluctuateoverthe31nlengthofthecontractandoutputadjustsonlyslowlytopricechanges.Finally,theinsider-outsidermodelarguesthatfirmsnegotiateonlywiththeiremployeesbutnottheunemployed.Sinceaturnoverofthelaborforceiscostlytofirms,theyarewillingtoofferabovemarket-clearingwagestothecurrentlyemployedratherthanhiringtheunemployedwhomaybewillingtoworkforless.Thesevariousexplanationsarenotmutuallyexclusive,andtheyallimplythattheAS-curveispositivelysloped,thatis,thatachangeinaggregatedemandwillaffectbothoutputandpricesintheshortrun.9.Trueorfalse?Why?"Thereisnofrictionalunemploymentatthenaturalrateofunemployment."False.Thenaturalrateofunemploymentistherateatwhichthelabormarketisinequilibrium.Butthereisalwayssomeunemploymentduetonewentrantsintothelaborforce,peoplebetweenjobs,andthelike.Thisrateofunemploymentisconsiderednormal,duetofrictionsinthelabormarket,andisoftencalledfrictionalunemployment.10."Ifeveryoneinthiseconomyhadrationalexpectations,thenwageswouldbeflexibleandunemploymentcouldnotoccur."Commentonthisstatement.ThenewKeynesianmodelsarguethatevenifpeoplehaverationalexpectations,sociallyundesirableoutcomesmaystilloccurduetoimperfectcompetitionandtheexistenceofwagecontracts.Pricesmaynotchangefreely,sincefirmsinimperfectlycompetitivemarketsarereluctanttochangethem,duetothemenucostsinvolved.Nominalwagesaresetbycontractsoveraperiodoftime,sotheeconomymayadjustonlyslowlytoadecreaseinaggregatedemand.Thusarateofunemploymenthigherthanthenaturalratecanexistoveranextendedperiodoftime.11.Trueorfalse?Why?"Ifnominalwagesweremoreflexible,expansionarypolicieswouldbemoreeffectiveinreducingtherateofunemployment."False.InChapter5welearnedthatintheclassicalcase(wherenominalwagesarecompletelyflexible)theAS-curveisvertical,whereasintheKeynesiancase(wherewagesdonotchange,evenifunemploymentpersists)theAS-curveishorizontal.Fromthiswecanconcludethatmoreflexiblenominalwagesimplyasteeperupward-slopingAS-curve.Anytypeofexpansionarydemand-sidepolicywillshifttheAD-curvetotherightandthiswillcausethelevelofoutputandpricestoincrease(atleastintheshort-run).Asteeperupward-slopingAS-curveresultsinalargerpriceincreaseandasmallerincreaseinoutput.Butasmallerincreaseinthelevelofoutputresultsinasmallerreductioninunemployment.Ineithercase,theeconomywillsettlebackatthefull-employmentlevelofoutputinthelongrun.Inthelongrun,therateofunemploymentalwaysgoesbacktoitsnaturallevel.3112.Explaintheshort-runandlong-runeffectsofanincreaseinthelevelofgovernmentspendingonoutput,unemployment,interestrates,prices,andrealmoneybalances.Anincreaseingovernmentspendingincreasesaggregatedemand,shiftingtheAD-curvetotheright.Becausethereisexcessdemand,thepricelevelincreases,whichreducesthelevelofrealmoneybalances.Thereforeinterestratesincrease,leadingtosomecrowdingoutofinvestment.Duetothisrealbalanceeffect,theincreaseinoutputislessthantheshiftintheAD-curve.Assuminganupward-slopingAS-curve,anewequilibriumisreachedatahigherpricelevel,ahigherlevelofoutput,alower44nunemploymentrateandahigherinterestrate.Sinceoutputisnowabovethefull-employmentlevel,wagesandpriceswillcontinuetoriseandtheupward-slopingAS-curvewillstartshiftingtotheleft.Thisprocesswillcontinueuntilanewlong-runequilibriumisreachedatthefull-employmentlevelofincomeY*,thatis,untilunemploymentisbackatitsnaturalrate.Atthispointthepricelevel,nominalwages,andinterestrateswillbehigherthanpreviouslyandrealmoneybalanceswillbelower.13.Brieflyexplainwhythereseemstobesomuchinterestinfindingwaystoshifttheupward-slopingaggregatesupplycurvetotheright.Shiftingtheupward-slopingAS-curvetotherightseemstobetheonlywaytooffsettheeffectsofanadversesupplyshockwithoutanynegativesideeffects.Anadversesupplyshock,suchasanincreaseinoilprices,causesasimultaneousincreaseinunemploymentandinflation,andpolicymakershaveonlytwooptionsfordemand-managementpolicies.Expansionaryfiscalormonetarypolicywillhelptoachievefullemploymentfasterbutwillraisethepricelevel,whilerestrictivefiscalormonetarypolicywillreduceinflationarypressurebutincreaseunemployment.Therefore,anypolicythatwouldshifttheupwardslopingAS-curvebacktotherightseemspreferable,sinceitmightbringtheeconomybacktotheoriginalequilibriumbysimultaneouslyloweringinflationandunemployment.14.UseanAD-ASframeworktoshowtheeffectofmonetaryrestrictiononthelevelofoutput,pricesandtheinterestrateinthemediumandthelongrun.Adecreaseinnominalmoneysupplywillincreaseinterestrates,leadingtoadecreaseininvestmentspending.ThiswillshifttheAD-curvetotheleft,creatinganexcesssupplyofgoodsandservices.Thereforepricelevelwilldecreaseandrealmoneybalanceswillincrease.AnewequilibriumwillbeachievedattheintersectionofthenewAD-curveandtheupward-slopingAS-curveatanoutputlevelthatisbelowthefull-employmentlevel.Inthelongrun,higherunemploymentwillcausedownwardpressureonwages.Asthecostofproductiondecreases,theupward-slopingAS-curvewillkeepshiftingtotherightuntilanewlong-runequilibriumisestablishedatthefull-employmentlevelofoutput,thatis,wherethenewAD-curveintersectsthelong-runverticalAS-curveatY*.Atthispoint,realoutput,therealinterestrate,realmoneybalances,andtherealwageratewillbebackattheiroriginallevel.Nominalmoneysupply,thepricelevelandthenominalwageratewillallhavedecreasedproportionally.Asimplifiedadjustmentcanbeshownasfollows:1-->2:Msdown==>iup==>Idown==>Ydown==>theAD-curveshiftsleft==>excesssupply==>Pdown==>realmsup==>idown==>Iup==>Yup44n(Thefirstlinedescribesapolicychange,thatis,ashiftintheAD-curve;thesecondlinedescribesthepriceadjustment,thatis,amovementalongtheAD-curve.)Short-runeffect:Ydown,iup,Pdown2-->3:SinceY查看更多