- 2022-04-09 发布 |

- 37.5 KB |

- 6页

申明敬告: 本站不保证该用户上传的文档完整性,不预览、不比对内容而直接下载产生的反悔问题本站不予受理。

文档介绍

罗斯《公司理财》英文习题答案DOCchap021

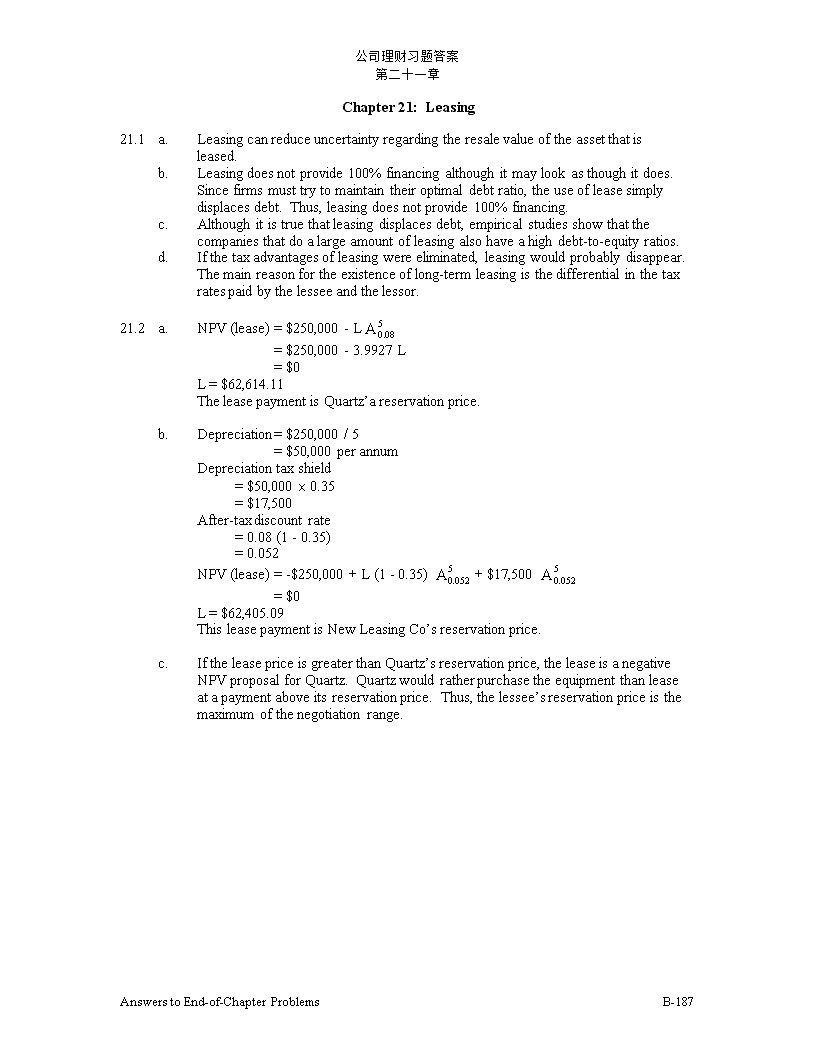

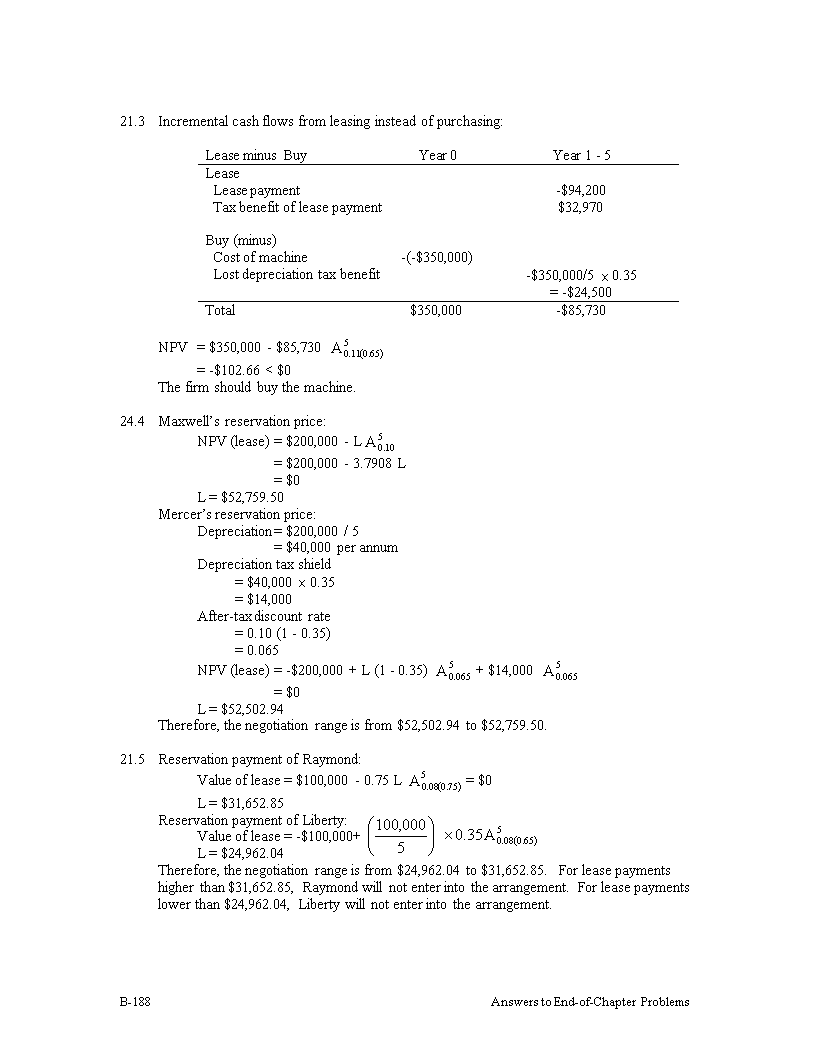

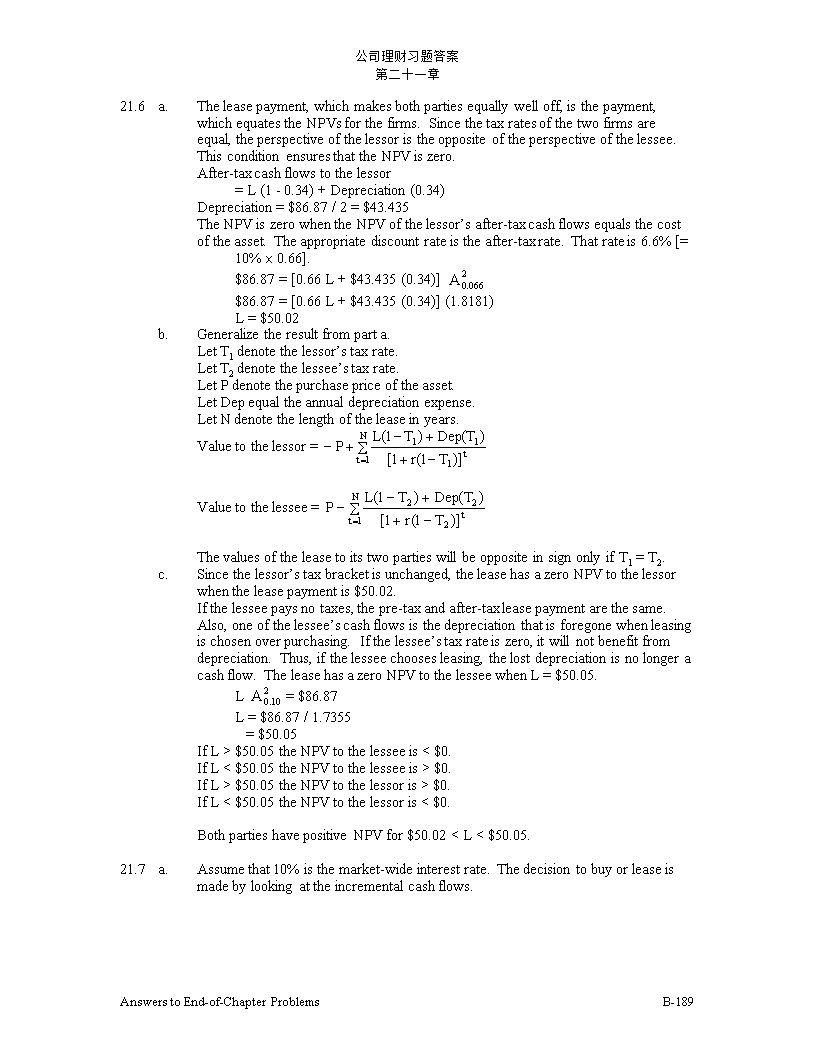

公司理财习题答案第二十一章Chapter21:Leasing21.1a.Leasingcanreduceuncertaintyregardingtheresalevalueoftheassetthatisleased.b.Leasingdoesnotprovide100%financingalthoughitmaylookasthoughitdoes.Sincefirmsmusttrytomaintaintheiroptimaldebtratio,theuseofleasesimplydisplacesdebt.Thus,leasingdoesnotprovide100%financing.c.Althoughitistruethatleasingdisplacesdebt,empiricalstudiesshowthatthecompaniesthatdoalargeamountofleasingalsohaveahighdebt-to-equityratios.d.Ifthetaxadvantagesofleasingwereeliminated,leasingwouldprobablydisappear.Themainreasonfortheexistenceoflong-termleasingisthedifferentialinthetaxratespaidbythelesseeandthelessor.21.2a.NPV(lease)=$250,000-L=$250,000-3.9927L=$0L=$62,614.11TheleasepaymentisQuartz’areservationprice.b.Depreciation=$250,000/5=$50,000perannumDepreciationtaxshield=$50,000´0.35=$17,500After-taxdiscountrate=0.08(1-0.35)=0.052NPV(lease)=-$250,000+L(1-0.35)+$17,500=$0L=$62,405.09ThisleasepaymentisNewLeasingCo’sreservationprice.c.IftheleasepriceisgreaterthanQuartz’sreservationprice,theleaseisanegativeNPVproposalforQuartz.Quartzwouldratherpurchasetheequipmentthanleaseatapaymentaboveitsreservationprice.Thus,thelessee’sreservationpriceisthemaximumofthenegotiationrange.B-191AnswerstoEnd-of-ChapterProblemsn公司理财习题答案第二十一章21.3Incrementalcashflowsfromleasinginsteadofpurchasing:LeaseminusBuyYear0Year1-5LeaseLeasepayment-$94,200Taxbenefitofleasepayment$32,970Buy(minus)Costofmachine-(-$350,000)Lostdepreciationtaxbenefit-$350,000/5´0.35=-$24,500Total$350,000-$85,730NPV=$350,000-$85,730=-$102.66<$0Thefirmshouldbuythemachine.24.4Maxwell’sreservationprice:NPV(lease)=$200,000-L=$200,000-3.7908L=$0L=$52,759.50Mercer’sreservationprice:Depreciation=$200,000/5=$40,000perannumDepreciationtaxshield=$40,000´0.35=$14,000After-taxdiscountrate=0.10(1-0.35)=0.065NPV(lease)=-$200,000+L(1-0.35)+$14,000=$0L=$52,502.94Therefore,thenegotiationrangeisfrom$52,502.94to$52,759.50.21.5ReservationpaymentofRaymond:Valueoflease=$100,000-0.75L=$0L=$31,652.85ReservationpaymentofLiberty:Valueoflease=-$100,000+L=$24,962.04Therefore,thenegotiationrangeisfrom$24,962.04to$31,652.85.Forleasepaymentshigherthan$31,652.85,Raymondwillnotenterintothearrangement.Forleasepaymentslowerthan$24,962.04,Libertywillnotenterintothearrangement.B-191AnswerstoEnd-of-ChapterProblemsn公司理财习题答案第二十一章21.6a.Theleasepayment,whichmakesbothpartiesequallywelloff,isthepayment,whichequatestheNPVsforthefirms.Sincethetaxratesofthetwofirmsareequal,theperspectiveofthelessoristheoppositeoftheperspectiveofthelessee.ThisconditionensuresthattheNPViszero.After-taxcashflowstothelessor=L(1-0.34)+Depreciation(0.34)Depreciation=$86.87/2=$43.435TheNPViszerowhentheNPVofthelessor’safter-taxcashflowsequalsthecostoftheasset.Theappropriatediscountrateistheafter-taxrate.Thatrateis6.6%[=10%´0.66].$86.87=[0.66L+$43.435(0.34)]$86.87=[0.66L+$43.435(0.34)](1.8181)L=$50.02b.Generalizetheresultfromparta.LetT1denotethelessor’staxrate.LetT2denotethelessee’staxrate.LetPdenotethepurchasepriceoftheasset.LetDepequaltheannualdepreciationexpense.LetNdenotethelengthoftheleaseinyears.Valuetothelessor=Valuetothelessee=ThevaluesoftheleasetoitstwopartieswillbeoppositeinsignonlyifT1=T2.c.Sincethelessor’staxbracketisunchanged,theleasehasazeroNPVtothelessorwhentheleasepaymentis$50.02.Ifthelesseepaysnotaxes,thepre-taxandafter-taxleasepaymentarethesame.Also,oneofthelessee’scashflowsisthedepreciationthatisforegonewhenleasingischosenoverpurchasing.Ifthelessee’staxrateiszero,itwillnotbenefitfromdepreciation.Thus,ifthelesseechoosesleasing,thelostdepreciationisnolongeracashflow.TheleasehasazeroNPVtothelesseewhenL=$50.05.L=$86.87L=$86.87/1.7355=$50.05IfL>$50.05theNPVtothelesseeis<$0.IfL<$50.05theNPVtothelesseeis>$0.IfL>$50.05theNPVtothelessoris>$0.IfL<$50.05theNPVtothelessoris<$0.BothpartieshavepositiveNPVfor$50.02查看更多

相关文章

- 当前文档收益归属上传用户