- 2022-08-19 发布 |

- 37.5 KB |

- 10页

申明敬告: 本站不保证该用户上传的文档完整性,不预览、不比对内容而直接下载产生的反悔问题本站不予受理。

文档介绍

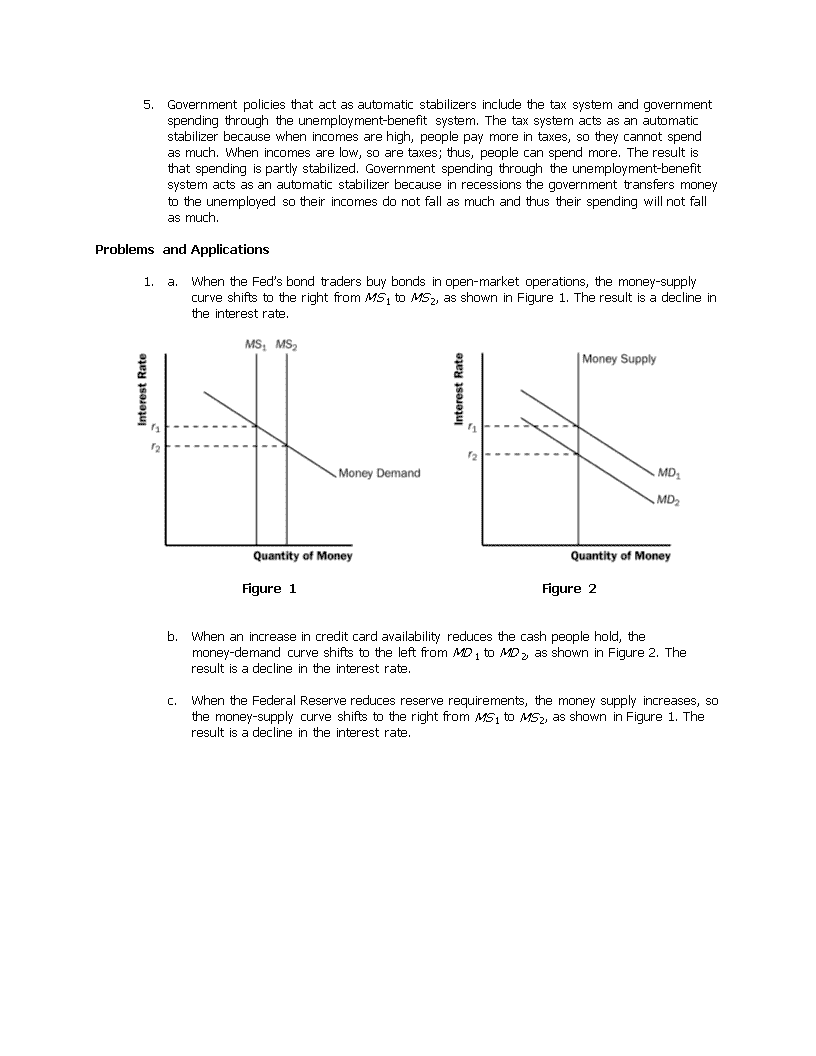

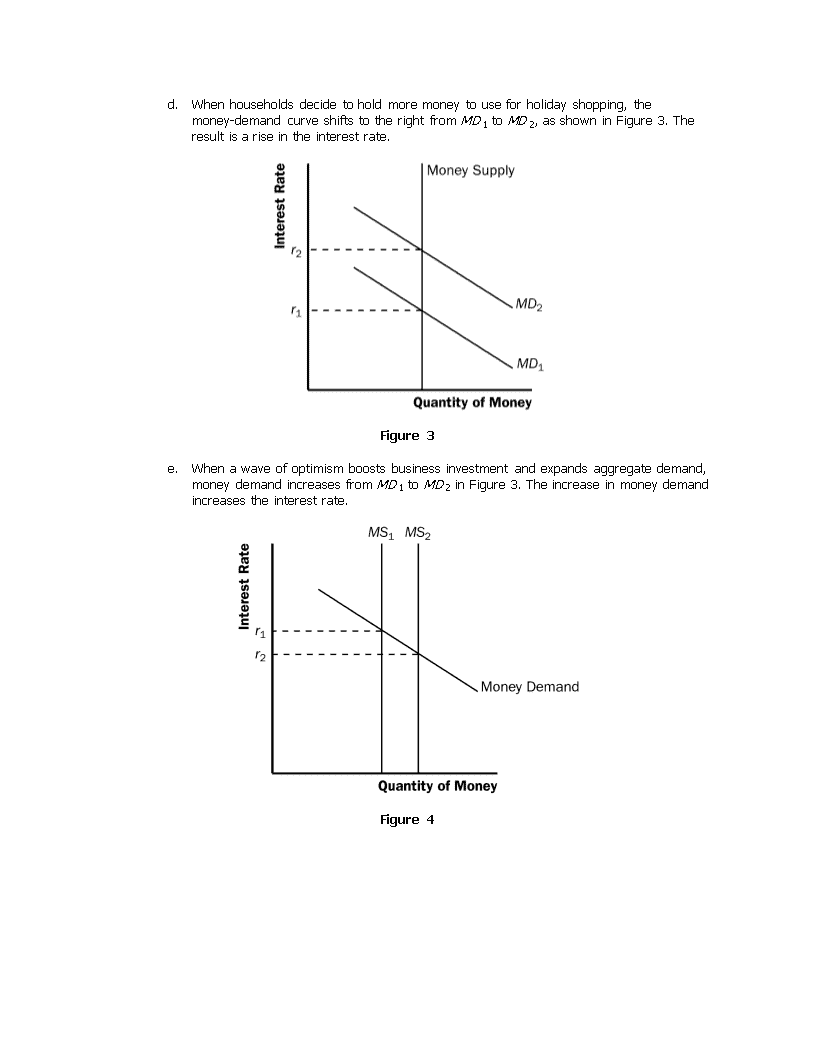

经济学原理答案

QuickQuizzes1.Accordingtothetheoryofliquiditypreference,theinterestrateadjuststobalancethesupplyanddemandformoney.Therefore,adecreaseinthemoneysupplywillincreasetheequilibriuminterestrate.Thisdecreaseinthemoneysupplyreducesaggregatedemandbecausethehigherinterestratecauseshouseholdstobuyfewerhouses,reducingthedemandforresidentialinvestment,andcausesfirmstospendlessonnewfactoriesandnewequipment,reducingbusinessinvestment.2.Ifthegovernmentreducesspendingonhighwayconstructionby$10billion,theaggregate-demandcurveshiftstotheleftbecausegovernmentpurchasesarelower.Theshifttotheleftoftheaggregate-demandcurvecouldbemorethan$10billionifthemultipliereffectoutweighsthecrowding-outeffect,oritcouldbelessthan$10billionifthecrowding-outeffectoutweighsthemultipliereffect.3.Ifpeoplebecomepessimisticaboutthefuture,theywillspendless,causingtheaggregate-demandcurvetoshifttotheleft.IftheFedwantstostabilizeaggregatedemand,itshouldincreasethemoneysupply.Theincreaseinthemoneysupplywillcausetheinterestratetodecline,thusstimulatingresidentialandbusinessinvestment.TheFedmightchoosenottodothisbecausebythetimethepolicyactiontakeseffect,thelonglagtimemightmeantheeconomywouldhaverecoveredonitsown,andtheincreaseinthemoneysupplywillcauseinflation.QuestionsforReview1.ThetheoryofliquiditypreferenceisKeynes'stheoryofhowtheinterestrateisdetermined.Accordingtothetheory,theaggregate-demandcurveslopesdownwardbecause:(1)ahigherpricelevelraisesmoneydemand;(2)highermoneydemandleadstoahigherinterestrate;and(3)ahigherinterestratereducesthequantityofgoodsandservicesdemanded.Thus,thepricelevelhasanegativerelationshipwiththequantityofgoodsandservicesdemanded.2.Adecreaseinthemoneysupplyshiftsthemoney-supplycurvetotheleft.Theequilibriuminterestratewillrise.Thehigherinterestratereducesconsumptionandinvestment,soaggregatedemandfalls.Thus,theaggregate-demandcurveshiftstotheleft.3.Ifthegovernmentspends$3billiontobuypolicecars,aggregatedemandmightincreasebymorethan$3billionbecauseofthemultipliereffectonaggregatedemand.Aggregatedemandmightincreasebylessthan$3billionbecauseofthecrowding-outeffectonaggregatedemand.4.Ifpessimismsweepsthecountry,householdsreduceconsumptionspendingandfirmsreduceinvestment,soaggregatedemandfalls.IftheFedwantstostabilizeaggregatedemand,itmustincreasethemoneysupply,reducingtheinterestrate,whichwillinducehouseholdstosavelessandspendmoreandwillencouragefirmstoinvestmore,bothofwhichwillincreaseaggregatedemand.IftheFeddoesnotincreasethemoneysupply,Congresscouldincreasegovernmentpurchasesorreducetaxestoincreaseaggregatedemand.\n5.Governmentpoliciesthatactasautomaticstabilizersincludethetaxsystemandgovernmentspendingthroughtheunemployment-benefitsystem.Thetaxsystemactsasanautomaticstabilizerbecausewhenincomesarehigh,peoplepaymoreintaxes,sotheycannotspendasmuch.Whenincomesarelow,soaretaxes;thus,peoplecanspendmore.Theresultisthatspendingispartlystabilized.Governmentspendingthroughtheunemployment-benefitsystemactsasanautomaticstabilizerbecauseinrecessionsthegovernmenttransfersmoneytotheunemployedsotheirincomesdonotfallasmuchandthustheirspendingwillnotfallasmuch.ProblemsandApplications1.a.WhentheFed’sbondtradersbuybondsinopen-marketoperations,themoney-supplycurveshiftstotherightfromMS1toMS2,asshowninFigure1.Theresultisadeclineintheinterestrate.Figure1Figure2b.Whenanincreaseincreditcardavailabilityreducesthecashpeoplehold,themoney-demandcurveshiftstotheleftfromMD1toMD2,asshowninFigure2.Theresultisadeclineintheinterestrate.c.WhentheFederalReservereducesreserverequirements,themoneysupplyincreases,sothemoney-supplycurveshiftstotherightfromMS1toMS2,asshowninFigure1.Theresultisadeclineintheinterestrate.\nd.Whenhouseholdsdecidetoholdmoremoneytouseforholidayshopping,themoney-demandcurveshiftstotherightfromMD1toMD2,asshowninFigure3.Theresultisariseintheinterestrate.Figure3e.Whenawaveofoptimismboostsbusinessinvestmentandexpandsaggregatedemand,moneydemandincreasesfromMD1toMD2inFigure3.Theincreaseinmoneydemandincreasestheinterestrate.Figure4\n2.a.Theincreaseinthemoneysupplywillcausetheequilibriuminterestratetodecline,asshowninFigure4.Householdswillincreasespendingandwillinvestinmorenewhousing.Firmstoowillincreaseinvestmentspending.ThiswillcausetheaggregatedemandcurvetoshifttotherightasshowninFigure5.Figure5b.AsshowninFigure5,theincreaseinaggregatedemandwillcauseanincreaseinbothoutputandthepricelevelintheshortrun(pointB).c.Whentheeconomymakesthetransitionfromitsshort-runequilibriumtoitslong-runequilibrium,short-runaggregatesupplywilldecline,causingthepriceleveltoriseevenfurther(pointC).d.Theincreaseinthepricelevelwillcauseanincreaseinthedemandformoney,raisingtheequilibriuminterestrate.e.Yes.Whileoutputinitiallyrisesbecauseoftheincreaseinaggregatedemand,itwillfallonceshort-runaggregatesupplydeclines.Thus,thereisnolong-runeffectoftheincreaseinthemoneysupplyonrealoutput.\nFigure63.a.WhenfewerATMsareavailable,moneydemandisincreasedandthemoney-demandcurveshiftstotherightfromMD1toMD2,asshowninFigure6.IftheFeddoesnotchangethemoneysupply,whichisatMS1,theinterestratewillrisefromr1tor2.Theincreaseintheinterestrateshiftstheaggregate-demandcurvetotheleft,asconsumptionandinvestmentfall.b.IftheFedwantstostabilizeaggregatedemand,itshouldincreasethemoneysupplytoMS2,sotheinterestratewillremainatr1andaggregatedemandwillnotchange.c.Toincreasethemoneysupplyusingopenmarketoperations,theFedshouldbuygovernmentbonds.4.Ataxcutthatispermanentwillhaveabiggerimpactonconsumerspendingandaggregatedemand.Ifthetaxcutispermanent,consumerswillviewitasaddingsubstantiallytotheirfinancialresources,andtheywillincreasetheirspendingsubstantially.Ifthetaxcutistemporary,consumerswillviewitasaddingjustalittletotheirfinancialresources,sotheywillnotincreasespendingasmuch.\n5.a.ThecurrentsituationisshowninFigure7.Figure7b.TheFedwillwanttostimulateaggregatedemand.Thus,itwillneedtolowertheinterestratebyincreasingthemoneysupply.ThiscouldbeachievediftheFedpurchasesgovernmentbondsfromthepublic.Figure8c.AsshowninFigure8,theFed'spurchaseofgovernmentbondsshiftsthesupplyofmoneytotheright,loweringtheinterestrate.d.TheFed'spurchaseofgovernmentbondswillincreaseaggregatedemandasconsumersandfirmsrespondtolowerinterestrates.OutputandthepricelevelwillriseasshowninFigure9.\nFigure96.a.Legislationallowingbankstopayinterestoncheckingdepositsincreasesthereturntomoneyrelativetootherfinancialassets,thusincreasingmoneydemand.b.Ifthemoneysupplyremainedconstant(atMS1),theincreaseinthedemandformoneywouldhaveraisedtheinterestrate,asshowninFigure10.Theriseintheinterestratewouldhavereducedconsumptionandinvestment,thusreducingaggregatedemandandoutput.c.Tomaintainaconstantinterestrate,theFedwouldneedtoincreasethemoneysupplyfromMS1toMS2.Thenaggregatedemandandoutputwouldbeunaffected.Figure107.a.Ifthereisnocrowdingout,thenthemultiplierequals1/(1–MPC).Becausethemultiplieris3,thenMPC=2/3.\nb.Ifthereiscrowdingout,thentheMPCwouldbelargerthan2/3.AnMPCthatislargerthan2/3wouldleadtoalargermultiplierthan3,whichisthenreduceddownto3bythecrowding-outeffect.8.a.Theinitialeffectofthetaxreductionof$20billionistoincreaseaggregatedemandby$20billion×3/4(theMPC)=$15billion.b.Additionaleffectsfollowthisinitialeffectastheaddedincomesarespent.Thesecondroundleadstoincreasedconsumptionspendingof$15billion×3/4=$11.25billion.Thethirdroundgivesanincreaseinconsumptionof$11.25billion×3/4=$8.44billion.Theeffectscontinueindefinitely.Addingthemallupgivesatotaleffectthatdependsonthemultiplier.WithanMPCof3/4,themultiplieris1/(1–3/4)=4.Sothetotaleffectis$15billion×4=$60billion.c.Governmentpurchaseshaveaninitialeffectofthefull$20billion,becausetheyincreaseaggregatedemanddirectlybythatamount.Thetotaleffectofanincreaseingovernmentpurchasesisthus$20billion×4=$80billion.Sogovernmentpurchasesleadtoabiggereffectonoutputthanataxcutdoes.Thedifferencearisesbecausegovernmentpurchasesaffectaggregatedemandbythefullamount,butataxcutispartlysavedbyconsumers,andthereforedoesnotleadtoasmuchofanincreaseinaggregatedemand.d.Thegovernmentcouldincreasetaxesbythesameamountitincreasesitspurchases.9.Ifthemarginalpropensitytoconsumeis0.8,thespendingmultiplierwillbe1/(1–0.8)=5.Therefore,thegovernmentwouldhavetoincreasespendingby$400/5=$80billiontoclosetherecessionarygap.10.Ifgovernmentspendingincreases,aggregatedemandrises,somoneydemandrises.TheincreaseinmoneydemandleadstoariseintheinterestrateandthusadeclineinaggregatedemandiftheFedkeepsthemoneysupplyconstant.ButiftheFedmaintainsafixedinterestrate,itwillincreasemoneysupply,soaggregatedemandwillnotdecline.Thus,theeffectonaggregatedemandfromanincreaseingovernmentspendingwillbelargeriftheFedmaintainsafixedinterestrate.11.a.Expansionaryfiscalpolicyismorelikelytoleadtoashort-runincreaseininvestmentiftheinvestmentacceleratorislarge.Alargeinvestmentacceleratormeansthattheincreaseinoutputcausedbyexpansionaryfiscalpolicywillinducealargeincreaseininvestment.Withoutalargeaccelerator,investmentmightdeclinebecausetheincreaseinaggregatedemandwillraisetheinterestrate.b.Expansionaryfiscalpolicyismorelikelytoleadtoashort-runincreaseininvestmentiftheinterestsensitivityofinvestmentissmall.Becausefiscalpolicyincreasesaggregatedemand,thusincreasingmoneydemandandtheinterestrate,thegreaterthesensitivityofinvestmenttotheinterestratethegreaterthedeclineininvestmentwillbe,whichwilloffsetthepositiveacceleratoreffect.12.a.Taxrevenuedeclineswhentheeconomygoesintoarecessionbecausetaxesarecloselyrelatedtoeconomicactivity.Inarecession,people'sincomesandwagesfall,asdofirms'profits,sotaxesonthesethingsdecline.b.Governmentspendingriseswhentheeconomygoesintoarecessionbecausemorepeoplegetunemployment-insurancebenefits,welfarebenefits,andotherformsofincomesupport.\nc.Ifthegovernmentweretooperateunderastrictbalanced-budgetrule,itwouldhavetoraisetaxratesorcutgovernmentspendinginarecession.Bothwouldreduceaggregatedemand,makingtherecessionmoresevere.13.a.Iftherewereacontractioninaggregatedemand,theFedwouldneedtoincreasethemoneysupplytoincreaseaggregatedemandandstabilizethepricelevel,asshowninFigure11.Byincreasingthemoneysupply,theFedisabletoshifttheaggregate-demandcurvebacktoAD1fromAD2.Thispolicystabilizesoutputandthepricelevel.Figure11b.Iftherewereanadverseshiftinshort-runaggregatesupply,theFedwouldneedtodecreasethemoneysupplytostabilizethepricelevel,shiftingtheaggregate-demandcurvetotheleftfromAD1toAD2,asshowninFigure12.Thisworsenstherecessioncausedbytheshiftinaggregatesupply.Tostabilizeoutput,theFedwouldneedtoincreasethemoneysupply,shiftingtheaggregate-demandcurvefromAD1toAD3.However,thisactionwouldraisethepricelevel.Figure12\n查看更多